Question: QUESTION 7 27 points Save Answer This is a File response type of question. You have to submit one SINGLE file (so I recommend Word

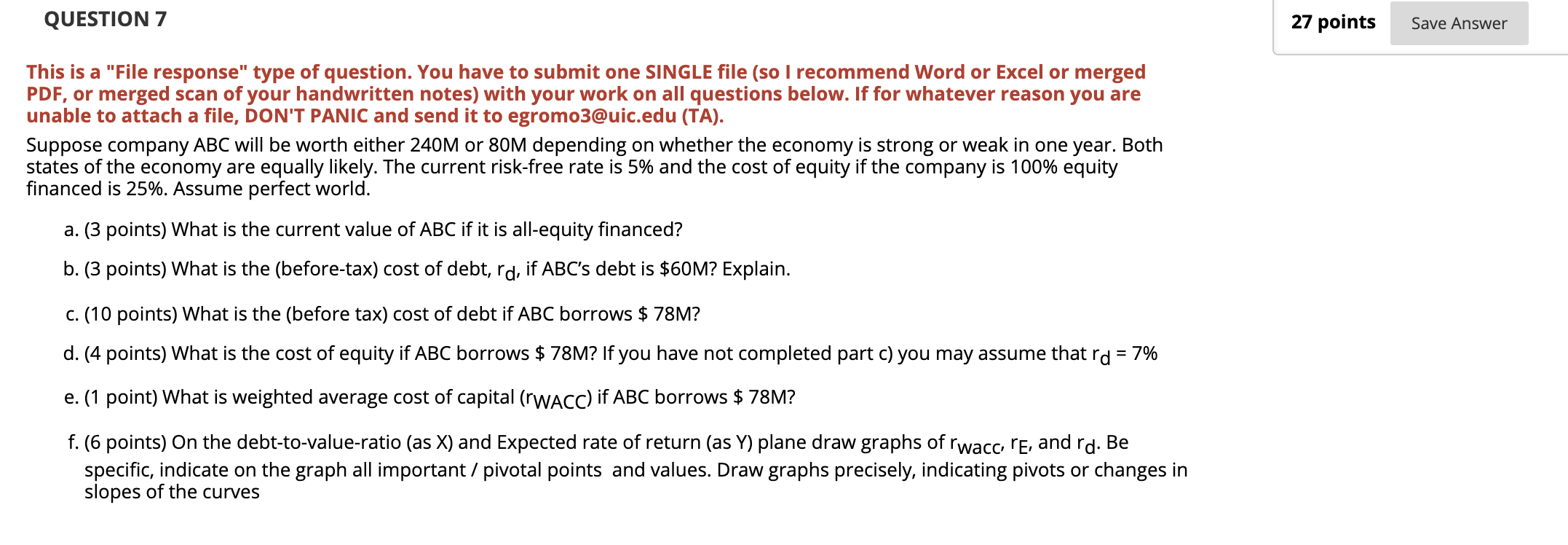

QUESTION 7 27 points Save Answer This is a "File response" type of question. You have to submit one SINGLE file (so I recommend Word or Excel or merged PDF, or merged scan of your handwritten notes) with your work on all questions below. If for whatever reason you are unable to attach a file, DON'T PANIC and send it to egromo3@uic.edu (TA). Suppose company ABC will be worth either 240M or 80M depending on whether the economy is strong or weak in one year. Both states of the economy are equally likely. The current risk-free rate is 5% and the cost of equity if the company is 100% equity financed is 25%. Assume perfect world. a. (3 points) What is the current value of ABC if it is all-equity financed? b. (3 points) What is the (before-tax) cost of debt, rd, if ABC's debt is $60M? Explain. C. (10 points) What is the (before tax) cost of debt if ABC borrows $ 78M? d. (4 points) What is the cost of equity if ABC borrows $ 78M? If you have not completed part C) you may assume that rd = 7% e. (1 point) What is weighted average cost of capital (WACC) if ABC borrows $ 78M? f. (6 points) On the debt-to-value-ratio (as X) and Expected rate of return (as Y) plane draw graphs of rwacc, re, and rd. Be specific, indicate on the graph all important / pivotal points and values. Draw graphs precisely, indicating pivots or changes in slopes of the curves QUESTION 7 27 points Save Answer This is a "File response" type of question. You have to submit one SINGLE file (so I recommend Word or Excel or merged PDF, or merged scan of your handwritten notes) with your work on all questions below. If for whatever reason you are unable to attach a file, DON'T PANIC and send it to egromo3@uic.edu (TA). Suppose company ABC will be worth either 240M or 80M depending on whether the economy is strong or weak in one year. Both states of the economy are equally likely. The current risk-free rate is 5% and the cost of equity if the company is 100% equity financed is 25%. Assume perfect world. a. (3 points) What is the current value of ABC if it is all-equity financed? b. (3 points) What is the (before-tax) cost of debt, rd, if ABC's debt is $60M? Explain. C. (10 points) What is the (before tax) cost of debt if ABC borrows $ 78M? d. (4 points) What is the cost of equity if ABC borrows $ 78M? If you have not completed part C) you may assume that rd = 7% e. (1 point) What is weighted average cost of capital (WACC) if ABC borrows $ 78M? f. (6 points) On the debt-to-value-ratio (as X) and Expected rate of return (as Y) plane draw graphs of rwacc, re, and rd. Be specific, indicate on the graph all important / pivotal points and values. Draw graphs precisely, indicating pivots or changes in slopes of the curves

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts