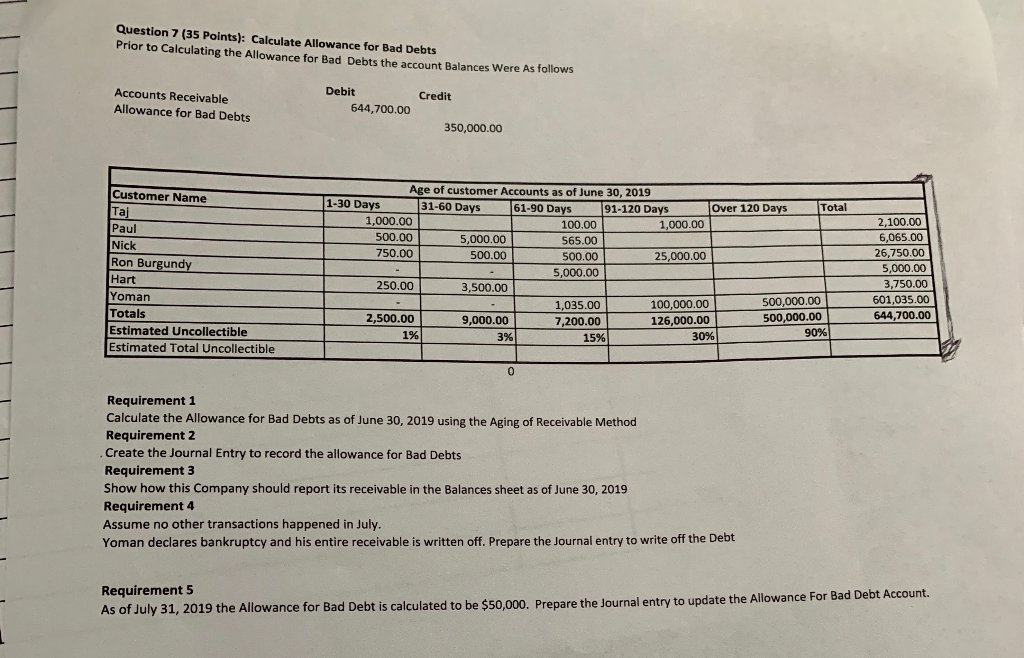

Question: Question 7 (35 Points): Calculate Allowance for Bad Debts Prior to Calculating the Allowance for Bad Debts the account Balances Were As follows Debit Accounts

Question 7 (35 Points): Calculate Allowance for Bad Debts Prior to Calculating the Allowance for Bad Debts the account Balances Were As follows Debit Accounts Receivable Allowance for Bad Debts Credit 644,700.00 50,000.00 Age of customer Accounts as of June 30, 2019 Customer Name Ta Paul Nick Ron Burgundy Hart Yoman Totals Estimated Uncollectible Estimated Total Uncollectible 2-30 Days31-60 Days 61-90 Days Total Over 120 Days 91-120 Days 1,000.00 500.00 750.00 2,100.00 6,065.00 26,750.00 5,000.00 3,750.00 601,035.00 100.00 565.00 500.00 5,000.00 1,000.00 5,000.00 500.00 25,000.00 250.00 3,500.00 500,000.00 100,000.00 1,035.00 7,200.00 15% 126,000.00500,000.00644700.00 2,500.00 1% 9,000.00 3% 90% 30% 0 Requirement 1 Calculate the Allowance for Bad Debts as of June 30, 2019 using the Aging of Receivable Method Requirement 2 Create the Journal Entry to record the allowance for Bad Debts Requirement 3 Show how this Company should report its receivable in the Balances sheet as of June 30, 2019 Requirement 4 Assume no other transactions happened in July Yoman declares bankruptcy and his entire receivable is written off. Prepare the Journal entry to write off the Debt Requirement 5 As of July 31, 2019 the Allowance for Bad Debt is calculated to be $50,0. Prepare the Journal entry to update the Allowance For

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts