Question: Question 7 (4 points) Required: Briefly explain whether the following are assessable as ordinary income or statutory income, or non-assessable (1 mark each) i. A

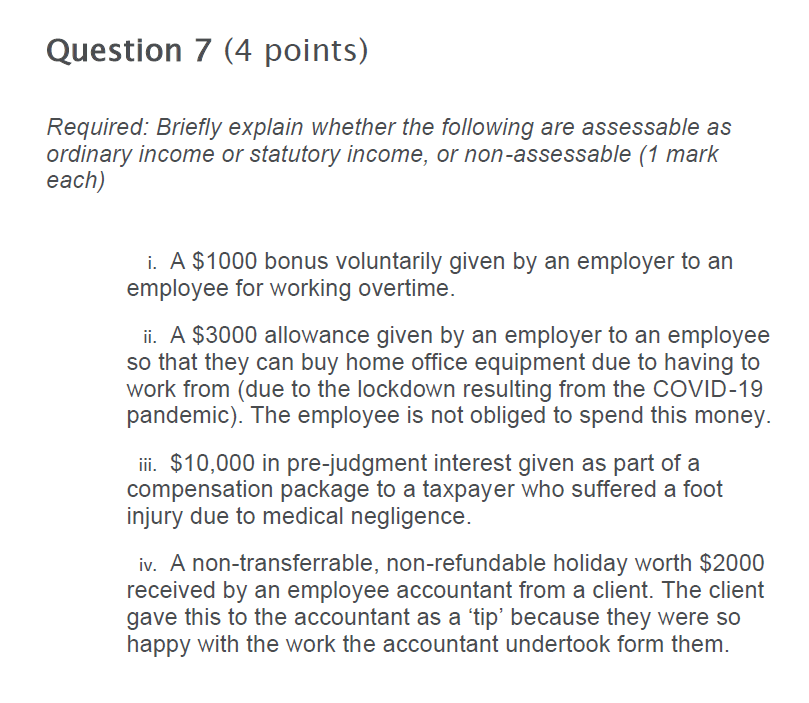

Question 7 (4 points) Required: Briefly explain whether the following are assessable as ordinary income or statutory income, or non-assessable (1 mark each) i. A $1000 bonus voluntarily given by an employer to an employee for working overtime. ii. A $3000 allowance given by an employer to an employee so that they can buy home office equipment due to having to work from (due to the lockdown resulting from the COVID-19 pandemic). The employee is not obliged to spend this money. iii. $10,000 in pre-judgment interest given as part of a compensation package to a taxpayer who suffered a foot injury due to medical negligence. iv. A non-transferrable, non-refundable holiday worth $2000 received by an employee accountant from a client. The client gave this to the accountant as a 'tip' because they were so happy with the work the accountant undertook form them

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts