Question: Question 7 5 ( 2 points ) Table 1 3 - 3 The following table presents the total tax liability for an unmarried taxpayer under

Question points

Table

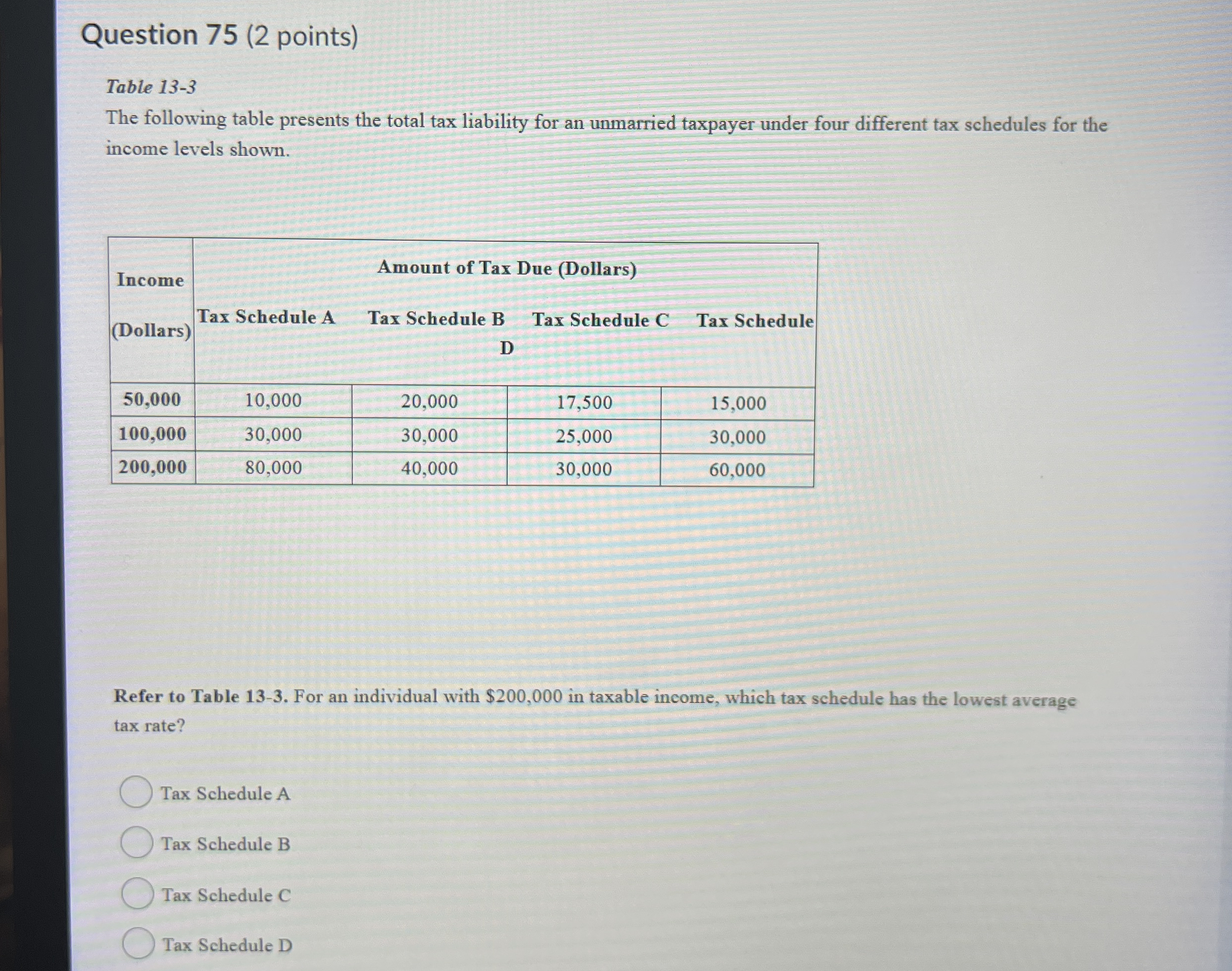

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

tableIncomeAmount of Tax Due DollarsDollarsTax Schedule ATax Schedule BTax Schedule CTax Schedule

Refer to Table For an individual with $ in taxable income, which tax schedule has the lowest average tax rate?

Tax Schedule A

Tax Schedule B

Tax Schedule C

Tax Schedule D

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock