Question: Question 7 5 points Save Answer XYZ Corp. currently has $10 million in excess cash that it plans on returning to its shareholders through a

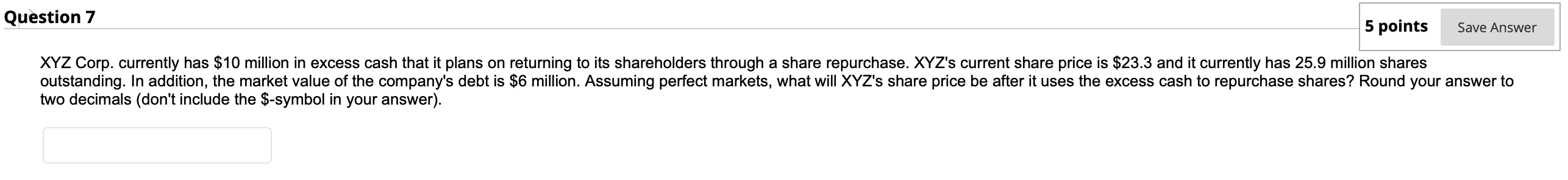

Question 7 5 points Save Answer XYZ Corp. currently has $10 million in excess cash that it plans on returning to its shareholders through a share repurchase. XYZ's current share price is $23.3 and it currently has 25.9 million shares outstanding. In addition, the market value of the company's debt is $6 million. Assuming perfect markets, what will XYZ's share price be after it uses the excess cash to repurchase shares? Round your answer to two decimals (don't include the $-symbol in your answer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts