Question: Question 7 5 points The expected return on ABC next year is 15% with a standard deviation of 20%. The expected return on GHI next

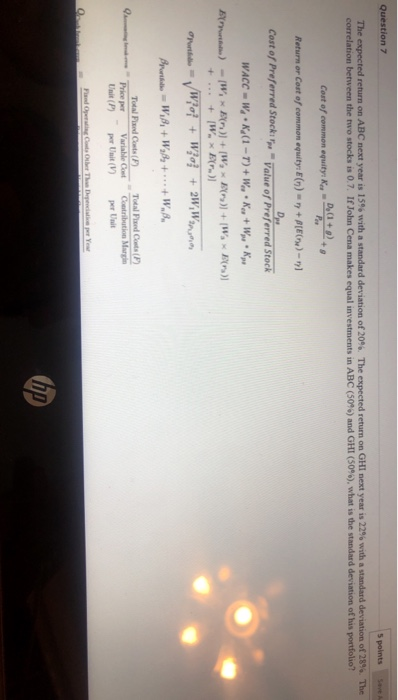

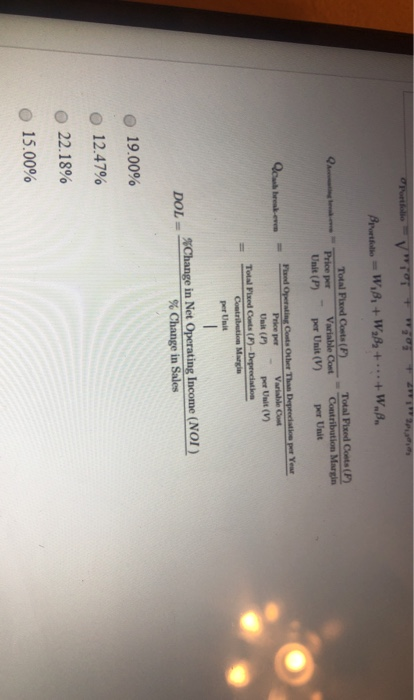

Question 7 5 points The expected return on ABC next year is 15% with a standard deviation of 20%. The expected return on GHI next year is 22% with a standard deviation of 28%. The correlation between the two stocks is 0.7. If John Cena makes equal investments in ABC (50%) and GHI (50%), what is the standard deviation of his portfolio? Cost of common equity: K. D. (1+2), Po Return or Cost of common equity: E() = 1 + [E(1) - Cost of Preferred Stockily Value of Preferred Stock D, WACC WK (1 - 1) + W., K+W. BY)-Wx n )] + W, *)] + Wix) + ... + W. * y)] W + W+ 2W,Wonin Broriste-W..+W.8, +...+W.. Total Fixed Cost (F) Price per Variable Cost Unit (P) Total Pedas Contribution Margin per Unit and Operatings Other Than Diper You DP portfolio V" Brothe-W,B,+W.1, +...+W.B. Total Fixed Costs (F) Price per Variable Cost Unit (P) Total Posted Coats (P) Contribution Margin Q per Unit (V) per Unit Qcwek. Peed Operating costs Other Than Depreciation per You Price per Variable Co Unit ( per Unit (V) Total Pixed Costs (1)-Depreciation Contribution Margie 1 DOL= Change in Net Operating Income (NOI) % Change in Sales 19.00% 12.47% 22.18% 15.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts