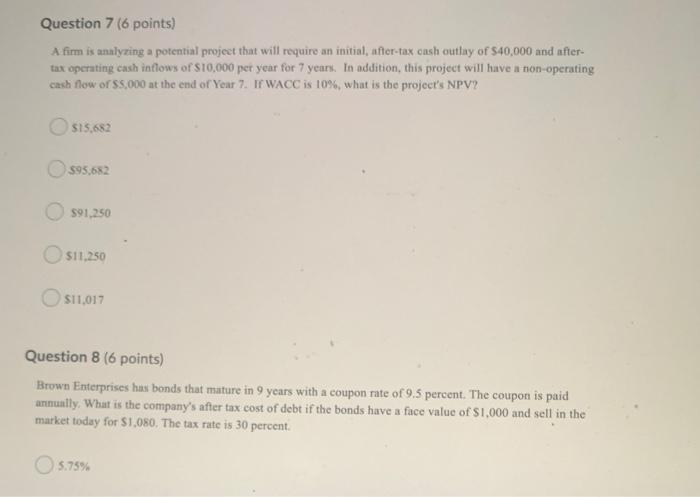

Question: Question 7 (6 points) A firm is analyzing a potential project that will require an initial, after-tax cash outlay of $40,000 and after tax operating

Question 7 (6 points) A firm is analyzing a potential project that will require an initial, after-tax cash outlay of $40,000 and after tax operating cash intlows of S10,000 per year for 7 years. In addition, this project will have a non-operating cash flow or 5.000 at the end of Year 7. I WACC is 10%, what is the project's NPV2 $15,652 395.682 $91,250 $11.250 S11,017 Question 8 (6 points) Brown Enterprises hus bonds that mature in 9 years with a coupon rate of 9.5 percent. The coupon is paid annually. What is the company's after tax cost of debt if the bonds have a face value of $1,000 and sell in the market today for $1,080. The tax rate is 30 percent 5.75%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts