Question

Question 7 A government issued a number of index-linked bonds on 1st September 2017 which were redeemed on 1st September 2019. Each bond had

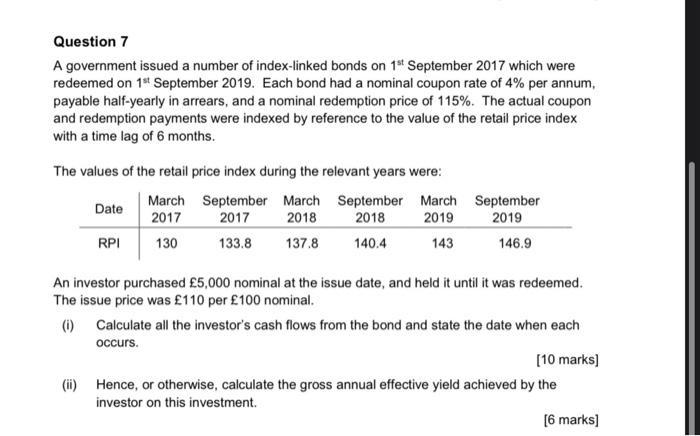

Question 7 A government issued a number of index-linked bonds on 1st September 2017 which were redeemed on 1st September 2019. Each bond had a nominal coupon rate of 4% per annum, payable half-yearly in arrears, and a nominal redemption price of 115%. The actual coupon and redemption payments were indexed by reference to the value of the retail price index with a time lag of 6 months. The values of the retail price index during the relevant years were: March September March September 2017 2017 2018 2018 130 133.8 137.8 140.4 Date RPI March 2019 143 September 2019 146.9 An investor purchased 5,000 nominal at the issue date, and held it until it was redeemed. The issue price was 110 per 100 nominal. (i) Calculate all the investor's cash flows from the bond and state the date when each occurs. [10 marks] (ii) Hence, or otherwise, calculate the gross annual effective yield achieved by the investor on this investment. [6 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

First lets calculate the total cash flows from the bond Coupon payment at March 2018 004 500 1404 ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started