Question: QUESTION 7 A portfolio is considered to be efficient if a. there is no portfolio with a higher return. b. it is the risk-minimizing portfolio.

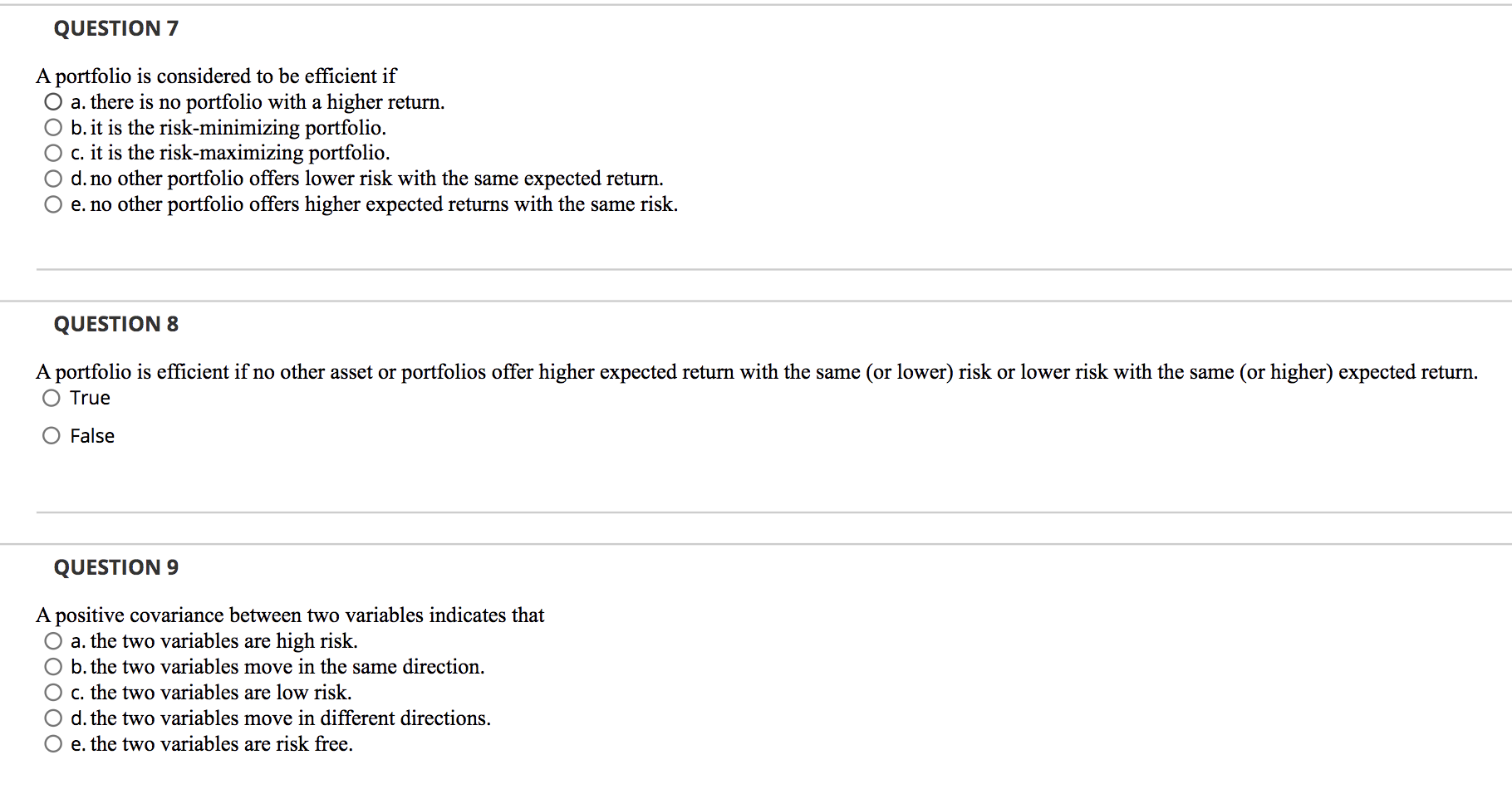

QUESTION 7 A portfolio is considered to be efficient if a. there is no portfolio with a higher return. b. it is the risk-minimizing portfolio. c. it is the risk-maximizing portfolio. d. no other portfolio offers lower risk with the same expected return. e. no other portfolio offers higher expected returns with the same risk. QUESTION 8 A portfolio is efficient if no other asset or portfolios offer higher expected return with the same (or lower) risk or lower risk with the same (or higher) expected return. O True False QUESTION 9 A positive covariance between two variables indicates that a. the two variables are high risk. b. the two variables move in the same direction. c. the two variables are low risk. d. the two variables move in different directions. e. the two variables are risk free.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts