Question: QUESTION 7 Adam Fleeman, a skilled carpenter started a home improvement business with Tom Collins, a master plumber. Adam and Tom are concerned about the

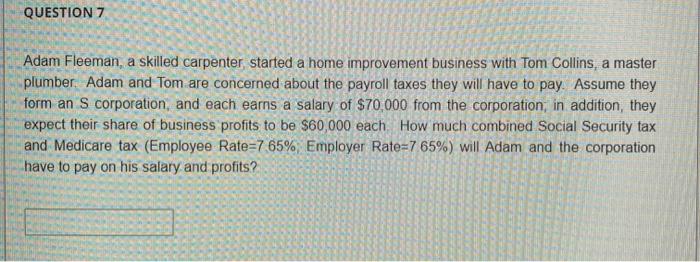

QUESTION 7 Adam Fleeman, a skilled carpenter started a home improvement business with Tom Collins, a master plumber. Adam and Tom are concerned about the payroll taxes they will have to pay. Assume they form an S corporation, and each earns a salary of $70,000 from the corporation, in addition, they expect their share of business profits to be $60,000 each How much combined Social Security tax and Medicare tax (Employee Rate=7 65% Employer Rate=7 65%) will Adam and the corporation have to pay on his salary and profits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts