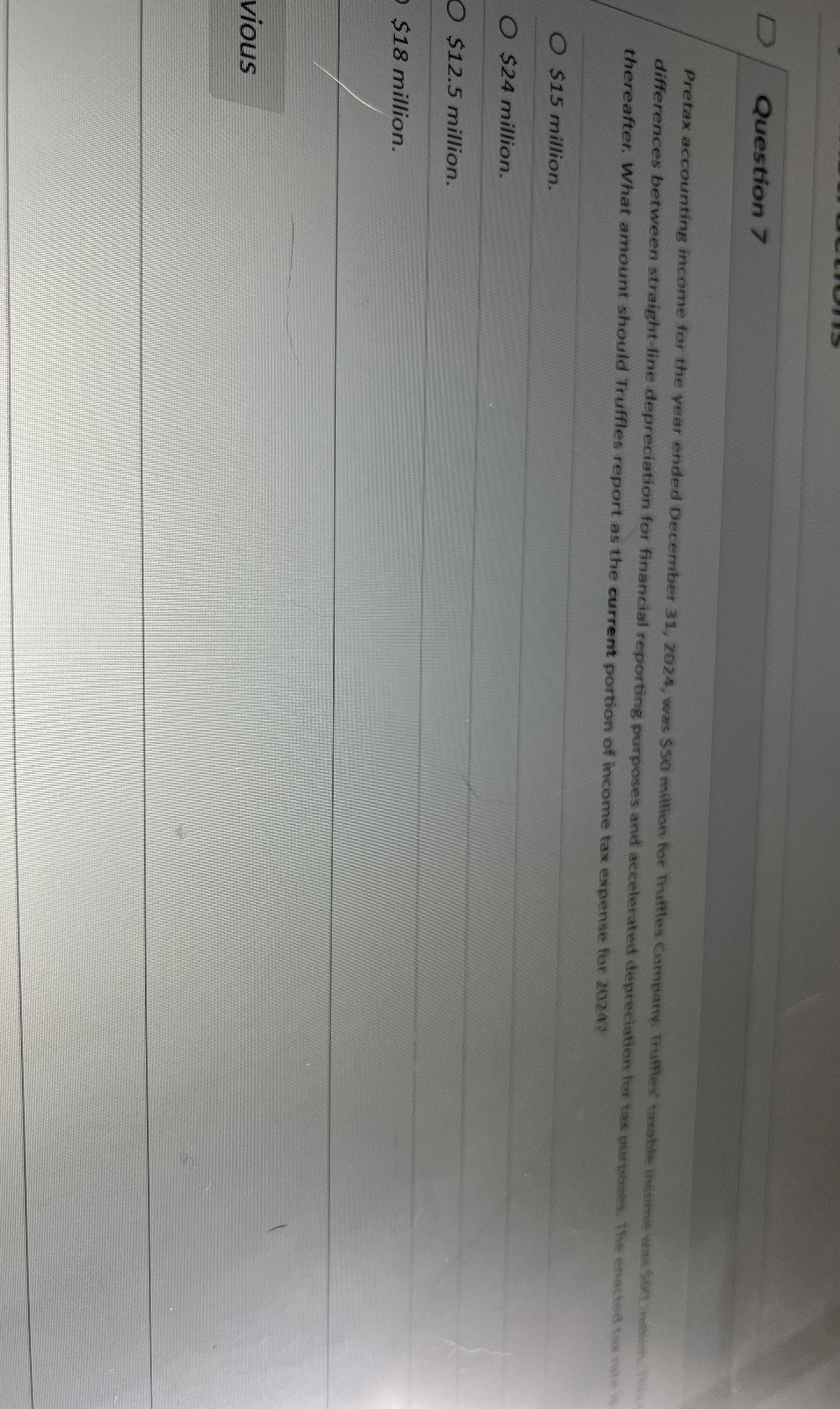

Question: Question 7 differences between straight - line depreciation for financial reporting purposes and accelerated depreciation for tax murposes . The chactod tox taxh thereafter. What

Question differences between straightline depreciation for financial reporting purposes and accelerated depreciation for tax murposes The chactod tox taxh thereafter. What amount should Truffles report as the current portion of income tax expense for

$ million.

$ million.

$ million.

$ million.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock