Question: QUESTION 7 MARKET VALUE CAPITAL STRUCTURE. A firm has 2 million shares of common stock outstanding at a book value of $2 per share. However

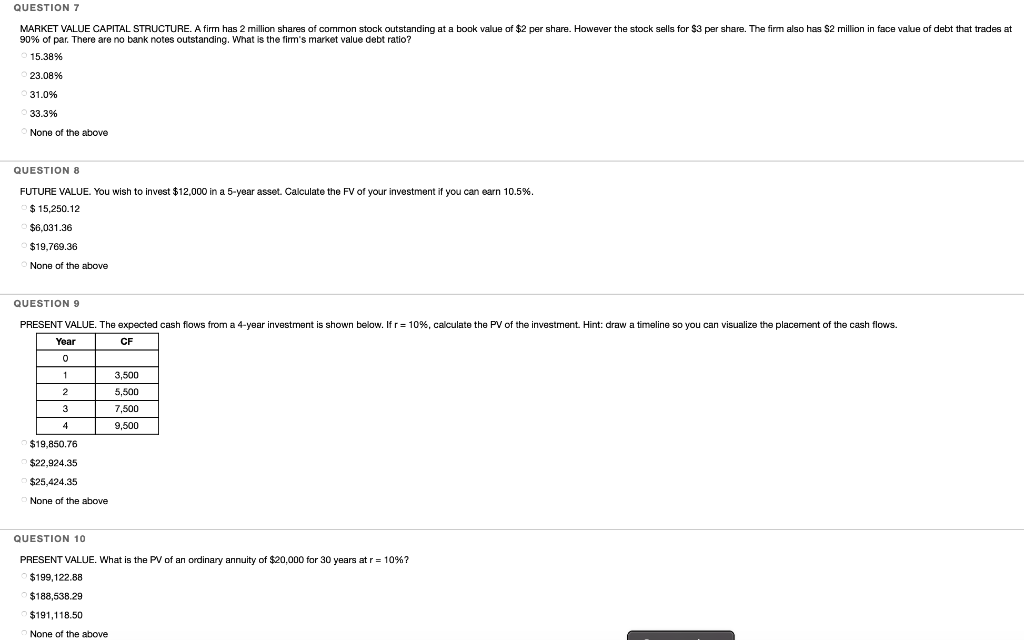

QUESTION 7 MARKET VALUE CAPITAL STRUCTURE. A firm has 2 million shares of common stock outstanding at a book value of $2 per share. However the stock sells for $3 per share. The firm also has $2 million in face value of debt that trades at 90% of par. There are no bank notes outstanding. What is the firm's market value debt ratio? 15.38% 23.08% 31.0% 33.3% None of the above QUESTION 8 FUTURE VALUE. You wish to invest $12,000 in a 5-year asset. Calculate the FV of your investment if you can earn 10.5%. $ 15,250.12 $6,031.36 $19,769.36 None of the above QUESTION 9 2 PRESENT VALUE. The expected cash flows from a 4-year investment is shown below. If r = 10%, calculate the PV of the investment. Hint: draw a timeline so you can visualize the placement of the cash flows. Year CF O 3,500 5,500 7,500 9,500 $19,850.76 $22,924.35 $25,424.35 None of the above QUESTION 10 PRESENT VALUE. What is the PV of an ordinary annuity of $20,000 for 30 years at r = 10%? $199,122.88 $ 188,538.29 $191,118.50 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts