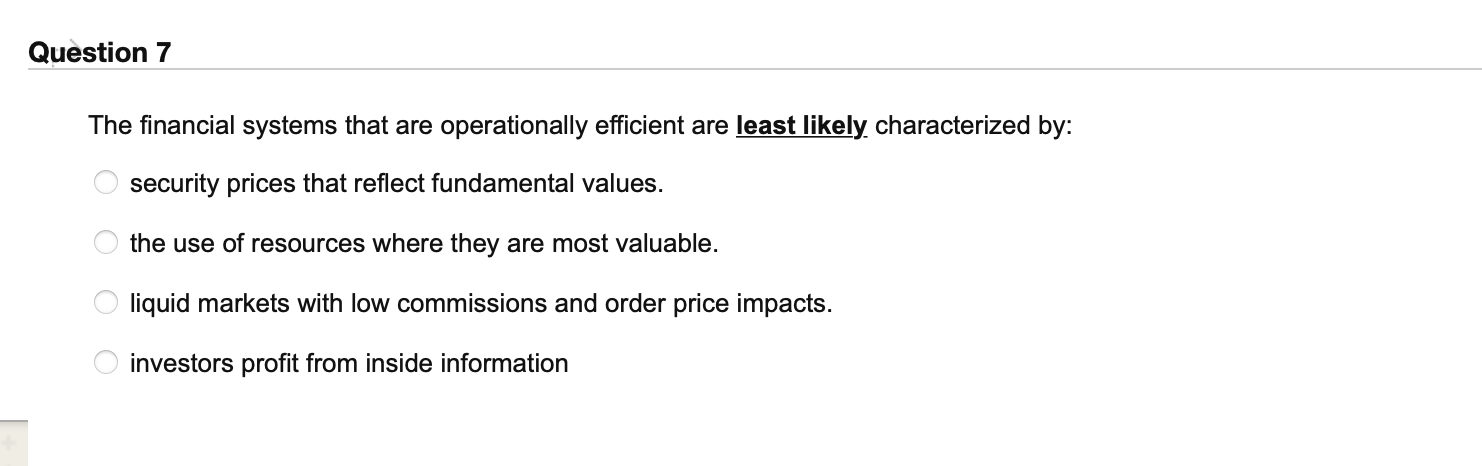

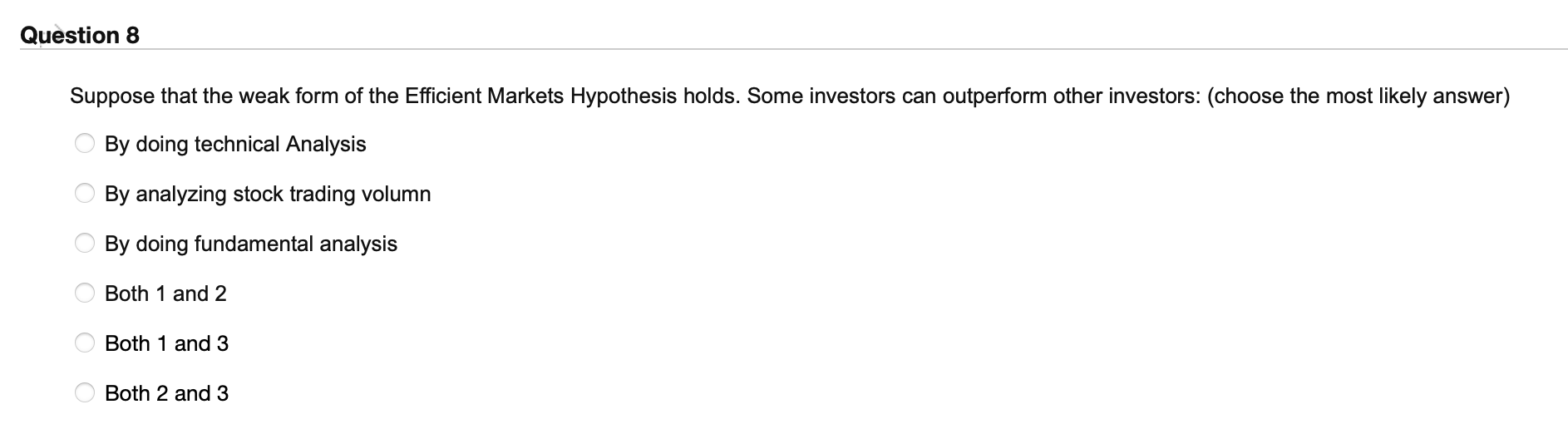

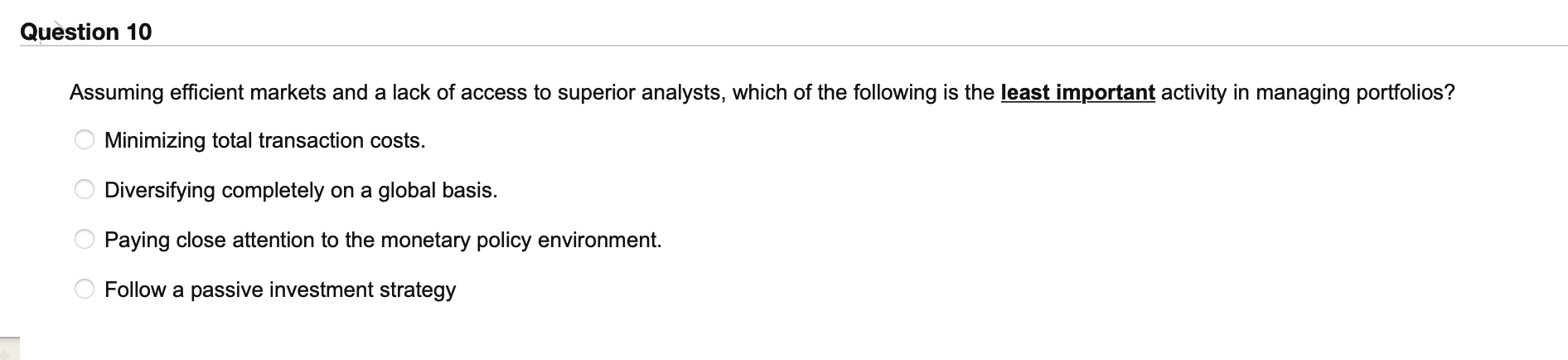

Question: Question 7 The financial systems that are operationally efficient are least likely characterized by: security prices that reflect fundamental values. O the use of resources

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts