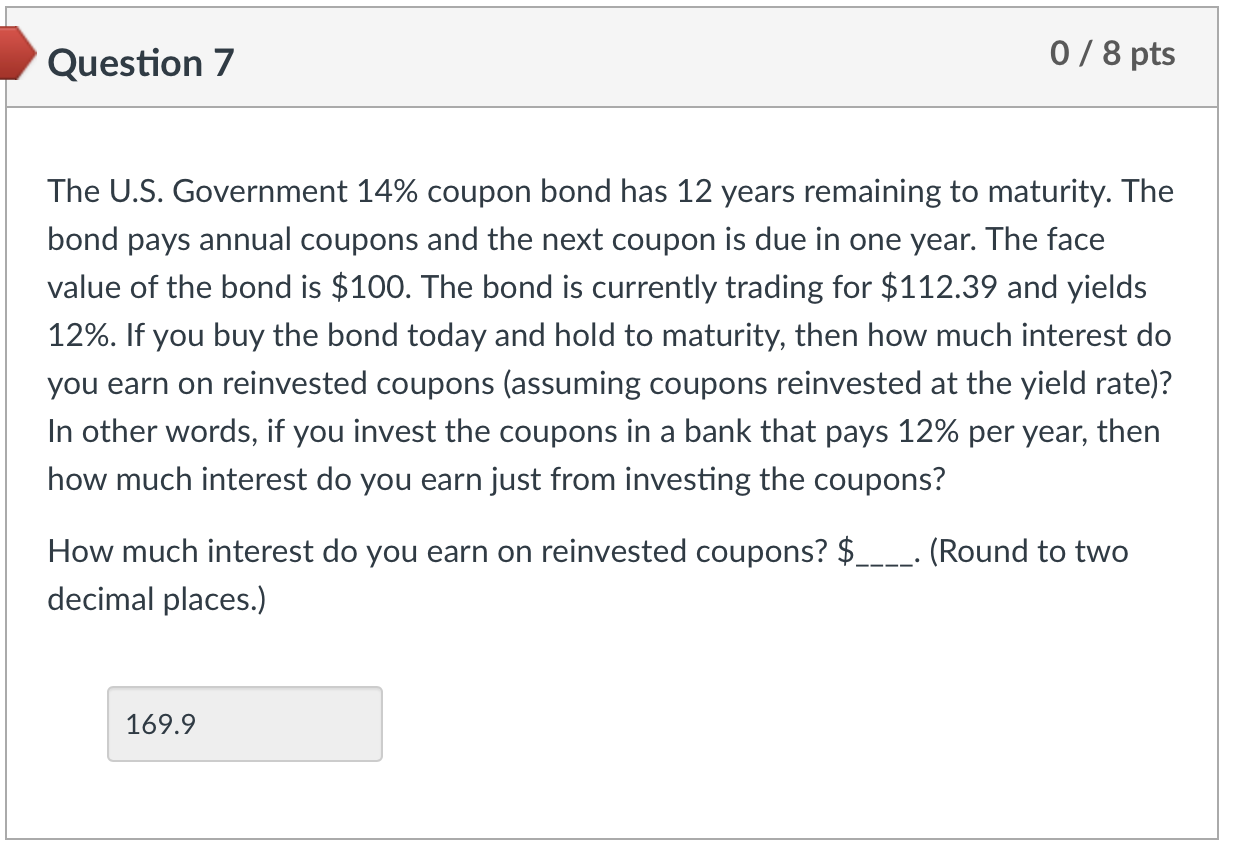

Question: Question 7 The U . S . Government 1 4 % coupon bond has 1 2 years remaining to maturity. The bond pays annual coupons

Question

The US Government coupon bond has years remaining to maturity. The

bond pays annual coupons and the next coupon is due in one year. The face

value of the bond is $ The bond is currently trading for $ and yields

If you buy the bond today and hold to maturity, then how much interest do

you earn on reinvested coupons assuming coupons reinvested at the yield rate

In other words, if you invest the coupons in a bank that pays per year, then

how much interest do you earn just from investing the coupons?

How much interest do you earn on reinvested coupons? $Round to two

decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock