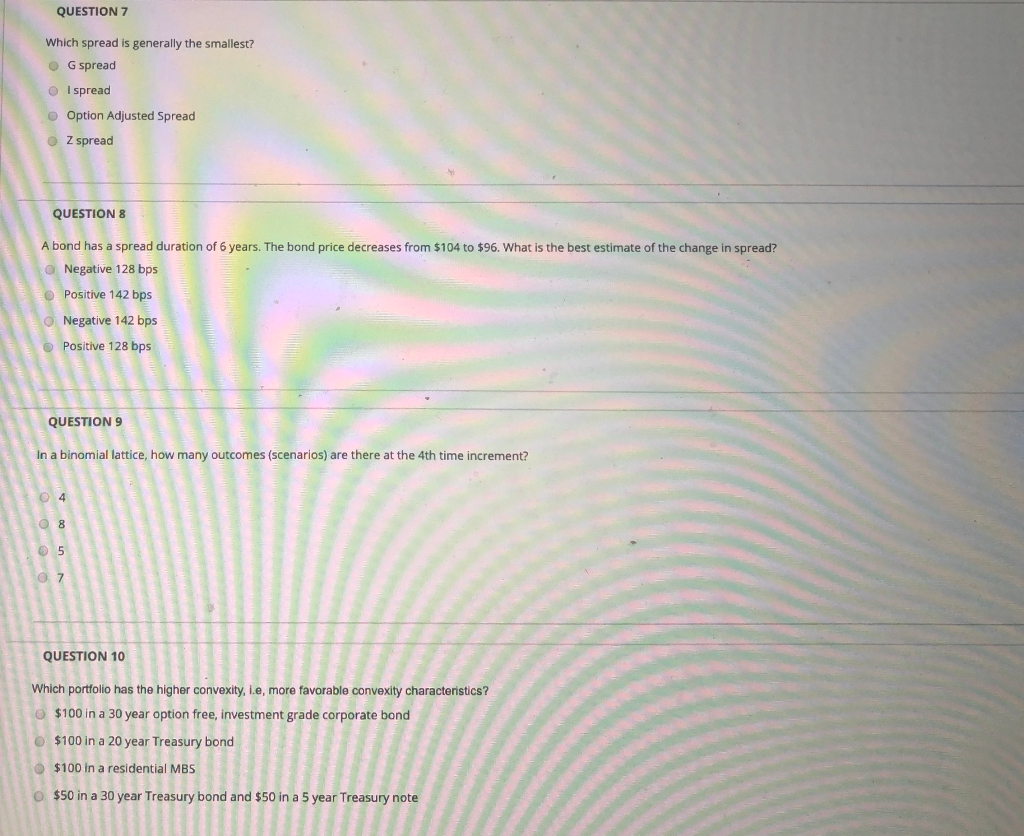

Question: QUESTION 7 Which spread is generally the smallest? OG spread I spread Option Adjusted Spread Z spread QUESTION 8 A bond has a spread duration

QUESTION 7 Which spread is generally the smallest? OG spread I spread Option Adjusted Spread Z spread QUESTION 8 A bond has a spread duration of 6 years. The bond price decreases from $104 to $96. What is the best estimate of the change in spread? Negative 128 bps Positive 142 bps O Negative 142 bps Positive 128 bps QUESTIONS a binomial lattice, how many outcomes (scenarios) are there at the 4th time increment? DO U QUESTION 10 Which portfolio has the higher convexity, i.e, more favorable convexity characteristics? $100 in a 30 year option free, investment grade corporate bond $100 in a 20 year Treasury bond $100 in a residential MBS o n free, investore w in a 20 ye O $50 in a 30 year Treasury bond and $50 in a 5 year Treasury

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts