Question: Reference(you can use or not use) Warrant Premium = [(Share Ratio * Warrant Price + Exercise Price) (Share Price)]/ Share Price Convertible Bond Conversion ratio

Reference(you can use or not use)

Warrant Premium = [(Share Ratio * Warrant Price + Exercise Price) (Share Price)]/ Share Price

Convertible Bond

Conversion ratio is the number of shares that is exchanged for a bond

Conversion Price = PAR (or face value) of the bond / conversion ratio.

Conversion value = current share price x conversion ratio.

Bond floor or investment value or straight value is the price of the bond if there is no conversion option

Conversion premium = (Convertible Bond Price Conversion Value) / conversion value

Investment premium = (Convertible Bond Price straight bond value) / straight bond value

Income pickup is the amount by which the yield to maturity of the convertible bond exceeds the dividend yield of the share

(please give correct and detail answers ,and no use excel ,because have mark)

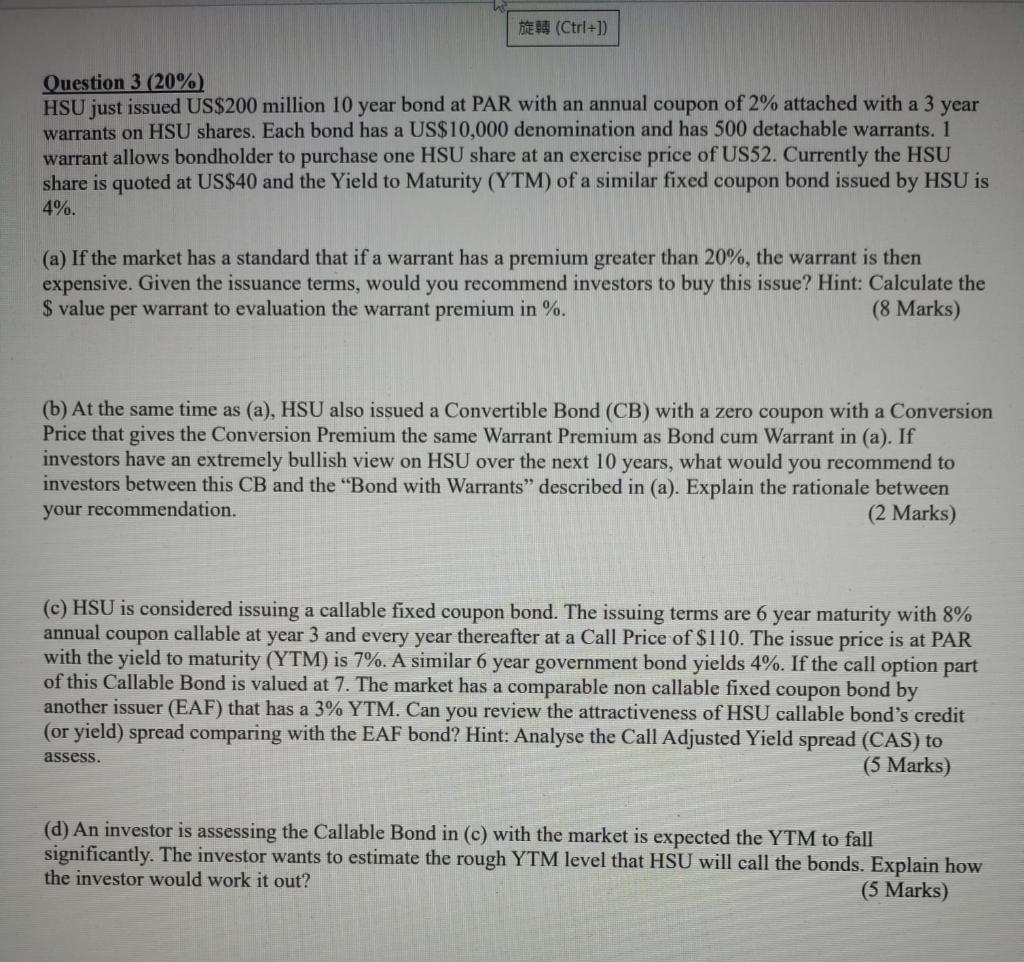

DESH (Ctrl+]) Question 3 (20%) HSU just issued US$200 million 10 year bond at PAR with an annual coupon of 2% attached with a 3 year warrants on HSU shares. Each bond has a US$10,000 denomination and has 500 detachable warrants. 1 warrant allows bondholder to purchase one HSU share at an exercise price of US52. Currently the HSU share is quoted at US$40 and the Yield to Maturity (YTM) of a similar fixed coupon bond issued by HSU is 4%. (a) If the market has a standard that if a warrant has a premium greater than 20%, the warrant is then expensive. Given the issuance terms, would you recommend investors to buy this issue? Hint: Calculate the $value per warrant to evaluation the warrant premium in %. (8 Marks) (b) At the same time as (a), HSU also issued a Convertible Bond (CB) with a zero coupon with a Conversion Price that gives the Conversion Premium the same Warrant Premium as Bond cum Warrant in (a). If investors have an extremely bullish view on HSU over the next 10 years, what would you recommend to investors between this CB and the "Bond with Warrants described in (a). Explain the rationale between your recommendation. (2 Marks) (c) HSU is considered issuing a callable fixed coupon bond. The issuing terms are 6 year maturity with 8% annual coupon callable at year 3 and every year thereafter at a Call Price of $110. The issue price is at PAR with the yield to maturity (YTM) is 7%. A similar 6 year government bond yields 4%. If the call option part of this Callable Bond is valued at 7. The market has a comparable non callable fixed coupon bond by another issuer (EAF) that has a 3% YTM. Can you review the attractiveness of HSU callable bond's credit (or yield) spread comparing with the EAF bond? Hint: Analyse the Call Adjusted Yield spread (CAS) to (5 Marks) assess. (d) An investor is assessing the Callable Bond in (c) with the market is expected the YTM to fall significantly. The investor wants to estimate the rough YTM level that HSU will call the bonds. Explain how the investor would work it out? (5 Marks) DESH (Ctrl+]) Question 3 (20%) HSU just issued US$200 million 10 year bond at PAR with an annual coupon of 2% attached with a 3 year warrants on HSU shares. Each bond has a US$10,000 denomination and has 500 detachable warrants. 1 warrant allows bondholder to purchase one HSU share at an exercise price of US52. Currently the HSU share is quoted at US$40 and the Yield to Maturity (YTM) of a similar fixed coupon bond issued by HSU is 4%. (a) If the market has a standard that if a warrant has a premium greater than 20%, the warrant is then expensive. Given the issuance terms, would you recommend investors to buy this issue? Hint: Calculate the $value per warrant to evaluation the warrant premium in %. (8 Marks) (b) At the same time as (a), HSU also issued a Convertible Bond (CB) with a zero coupon with a Conversion Price that gives the Conversion Premium the same Warrant Premium as Bond cum Warrant in (a). If investors have an extremely bullish view on HSU over the next 10 years, what would you recommend to investors between this CB and the "Bond with Warrants described in (a). Explain the rationale between your recommendation. (2 Marks) (c) HSU is considered issuing a callable fixed coupon bond. The issuing terms are 6 year maturity with 8% annual coupon callable at year 3 and every year thereafter at a Call Price of $110. The issue price is at PAR with the yield to maturity (YTM) is 7%. A similar 6 year government bond yields 4%. If the call option part of this Callable Bond is valued at 7. The market has a comparable non callable fixed coupon bond by another issuer (EAF) that has a 3% YTM. Can you review the attractiveness of HSU callable bond's credit (or yield) spread comparing with the EAF bond? Hint: Analyse the Call Adjusted Yield spread (CAS) to (5 Marks) assess. (d) An investor is assessing the Callable Bond in (c) with the market is expected the YTM to fall significantly. The investor wants to estimate the rough YTM level that HSU will call the bonds. Explain how the investor would work it out

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts