Question: Question 71 (1 point) The cash flows below provide the expected year 1 cash flows for a potential real estate investment. Based on these numbers

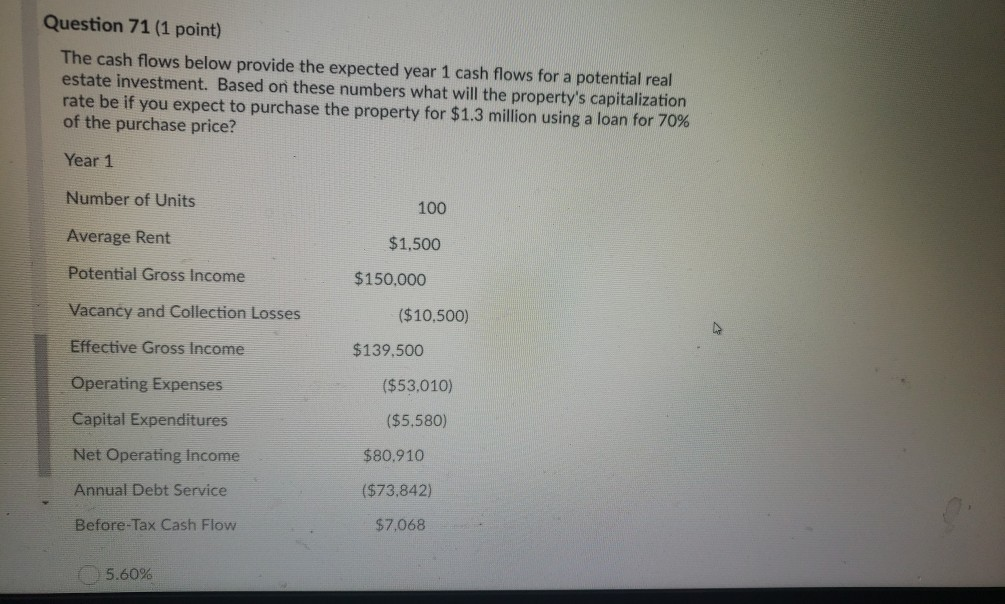

Question 71 (1 point) The cash flows below provide the expected year 1 cash flows for a potential real estate investment. Based on these numbers what will the property's capitalization rate be if you expect to purchase the property for $1.3 million using a loan for 70% of the purchase price? Year 1 Number of Units Average Rent Potential Gross Income 100 $1,500 $150,000 ($10.500) $139,500 ($53,010) Vacancy and Collection Losses Effective Gross Income Operating Expenses Capital Expenditures Net Operating Income ($5.580) $80.910 ($73,842) Annual Debt Service Before-Tax Cash Flow $7,068 5.60%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock