Question: Question 7.15 point possible (graded Now that you know the meant retutti, standard deviation, and the critical z values, it is straightforward to compute VaR

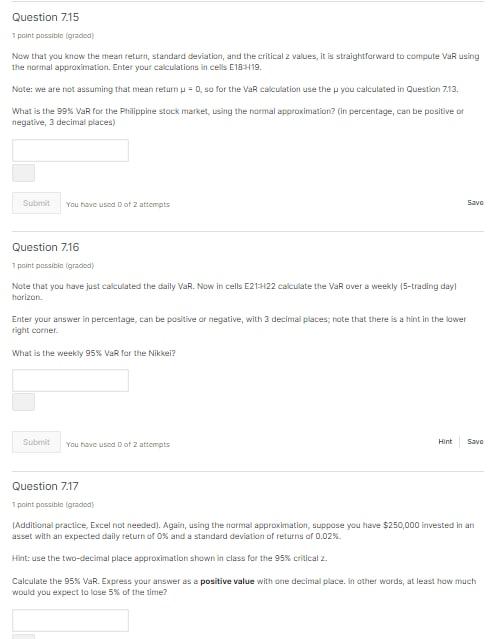

Question 7.15 point possible (graded Now that you know the meant retutti, standard deviation, and the critical z values, it is straightforward to compute VaR using the normal approximation. Enter your calculations in cells E18-19. Note: we are not assuming that mean retum p = 0. so for the VaR calculation use the H you calculated in Question 713. What is the 99% VaR for the Philippine stock market, using the normal approximation? (in percentage, can be positive of negative, 3 decimal places) Sub You have used Dot 2 attemats Savo Question 7.16 point possible graced) Note that you have just calculated the daily VaR. Now in cells E21322 calculate the VaR over a weekly 15-trading day horizon Enter your answer in percentage, can be positive or negative, with 3 decimai places; note that there is a hint in the lower right corner What is the weekly 95% VaR for the Nikkel? Submit Hint Savo You have used Dot 2 attempts Question 7.17 point possible grado Additional practice, Excel not needed). Again, using the natmal approximation, suppose you have $250,000 invested in an asset with an expected daily return of o% and a standard deviation of returns of 0.02% Hint use the two-decimal place approximation shown in class for the 95% critical 2. Calculate the 95% VaR. Express your answer as a positive value with one decimal place. In other words, at least how much would you expect to lose 5% of the time? Question 7.15 point possible (graded Now that you know the meant retutti, standard deviation, and the critical z values, it is straightforward to compute VaR using the normal approximation. Enter your calculations in cells E18-19. Note: we are not assuming that mean retum p = 0. so for the VaR calculation use the H you calculated in Question 713. What is the 99% VaR for the Philippine stock market, using the normal approximation? (in percentage, can be positive of negative, 3 decimal places) Sub You have used Dot 2 attemats Savo Question 7.16 point possible graced) Note that you have just calculated the daily VaR. Now in cells E21322 calculate the VaR over a weekly 15-trading day horizon Enter your answer in percentage, can be positive or negative, with 3 decimai places; note that there is a hint in the lower right corner What is the weekly 95% VaR for the Nikkel? Submit Hint Savo You have used Dot 2 attempts Question 7.17 point possible grado Additional practice, Excel not needed). Again, using the natmal approximation, suppose you have $250,000 invested in an asset with an expected daily return of o% and a standard deviation of returns of 0.02% Hint use the two-decimal place approximation shown in class for the 95% critical 2. Calculate the 95% VaR. Express your answer as a positive value with one decimal place. In other words, at least how much would you expect to lose 5% of the time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts