Question: Question 7c and 7d (4 marks) C) A hedge fund manager engages in a relative value trade. She takes a long position on GM Holden

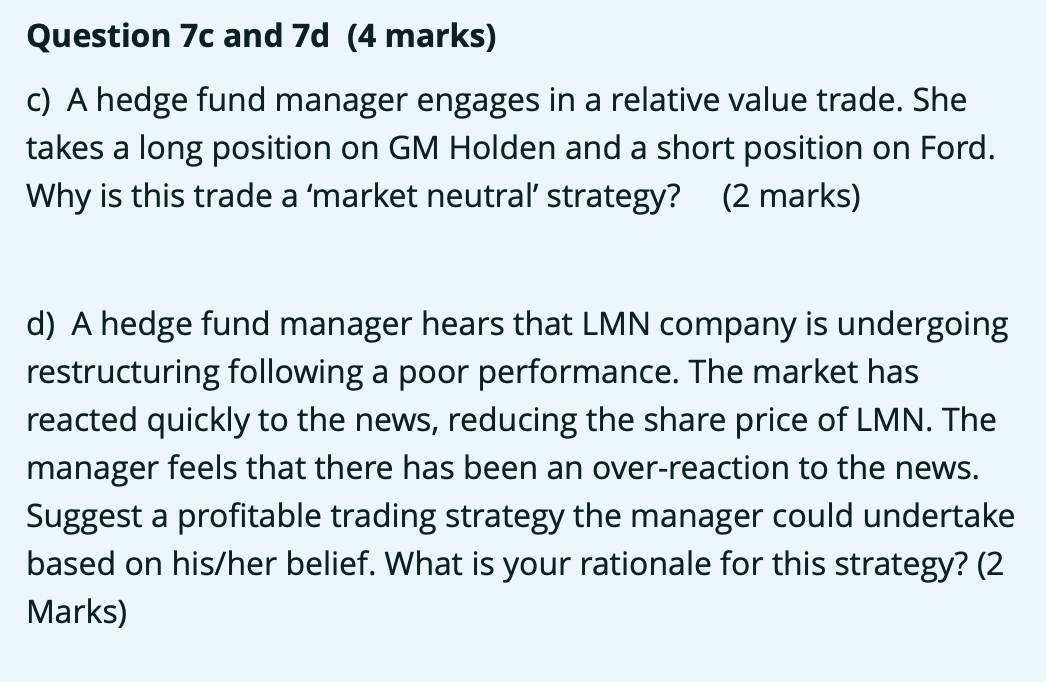

Question 7c and 7d (4 marks) C) A hedge fund manager engages in a relative value trade. She takes a long position on GM Holden and a short position on Ford. Why is this trade a 'market neutral strategy? (2 marks) d) A hedge fund manager hears that LMN company is undergoing restructuring following a poor performance. The market has reacted quickly to the news, reducing the share price of LMN. The manager feels that there has been an over-reaction to the news. Suggest a profitable trading strategy the manager could undertake based on his/her belief. What is your rationale for this strategy? (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts