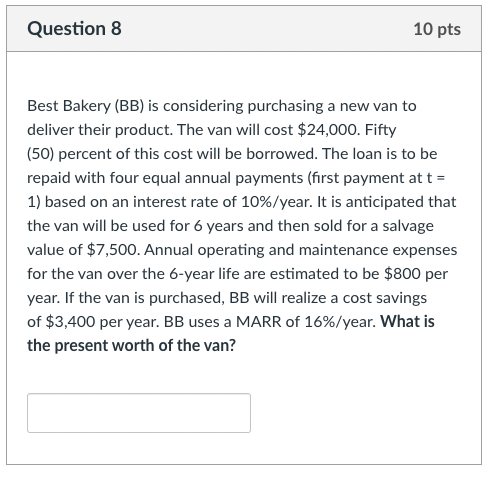

Question: Question 8 1 0 pts Best Bakery ( BB ) is considering purchasing a new van to deliver their product. The van will cost

Question pts Best Bakery BB is considering purchasing a new van to deliver their product. The van will cost $ Fifty percent of this cost will be borrowed. The loan is to be repaid with four equal annual payments first payment at t based on an interest rate of year. It is anticipated that the van will be used for years and then sold for a salvage value of $ Annual operating and maintenance expenses for the van over the year life are estimated to be $ per year. If the van is purchased, BB will realize a cost savings of $ per year. BB uses a MARR of year. What is the present worth of the van? Consider question Based on the present worth analysis, is the van purchase economically attractive?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock