Question: Question 8 ( 1 2 points ) CafeSi Inc. is constructing its Cost of Capital schedule. The firm is at its target capital structure. Its

Question points

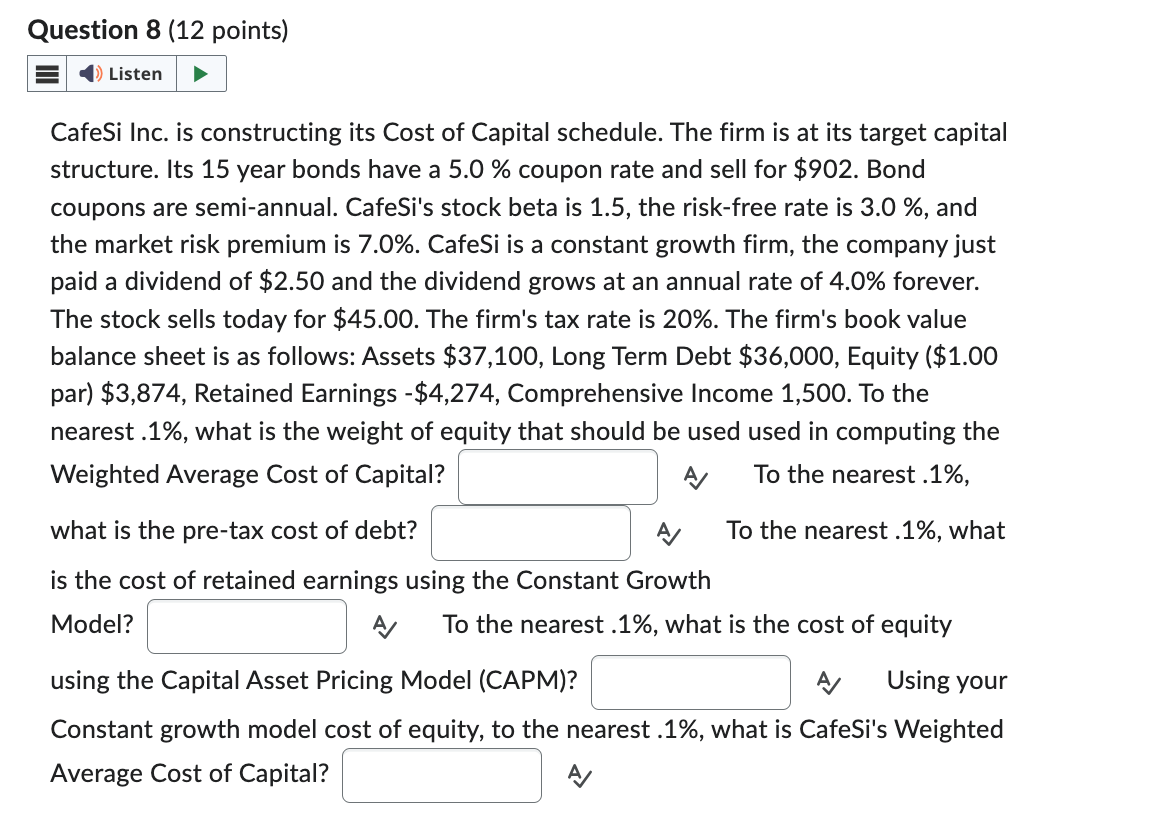

CafeSi Inc. is constructing its Cost of Capital schedule. The firm is at its target capital

structure. Its year bonds have a coupon rate and sell for $ Bond

coupons are semiannual. CafeSi's stock beta is the riskfree rate is and

the market risk premium is CafeSi is a constant growth firm, the company just

paid a dividend of $ and the dividend grows at an annual rate of forever.

The stock sells today for $ The firm's tax rate is The firm's book value

balance sheet is as follows: Assets $ Long Term Debt $$

par$ Retained Earnings $ Comprehensive Income To the

nearest what is the weight of equity that should be used used in computing the

Weighted Average Cost of Capital?

what is the pretax cost of debt?

A To the nearest.

is

A To the nearest. what

is the cost of retained earnings using the Constant Growth

Model?

To the nearest what is the cost of equity

using the Capital Asset Pricing Model CAPM

A Using your

Constant growth model cost of equity, to the nearest what is CafeSi's Weighted

Average Cost of Capital?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock