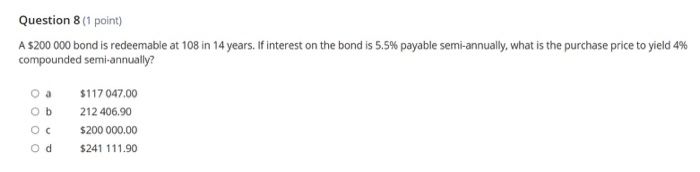

Question: Question 8 (1 point) A $200 000 bond is redeemable at 108 in 14 years. If interest on the bond is 5.5% payable semi-annually, what

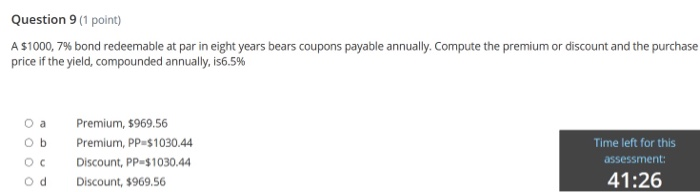

Question 8 (1 point) A $200 000 bond is redeemable at 108 in 14 years. If interest on the bond is 5.5% payable semi-annually, what is the purchase price to yield 4% compounded semi-annually? Ob OC od $117 047.00 212 406.90 $200 000.00 $241 111.90 Question 9 (1 point) A $1000, 7% bond redeemable at par in eight years bears coupons payable annually. Compute the premium or discount and the purchase price if the yield, compounded annually, is6.5% Ob Premium, $969.56 Premium, PP-$1030.44 Discount, PP-$1030.44 Discount, $969.56 Time left for this assessment: 41:26 Od

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock