Question: Question 8 (1 point) Saved On July 2, 2020, a taxpayer placed in service a new computer that cost $4,000. The computer is used 100%

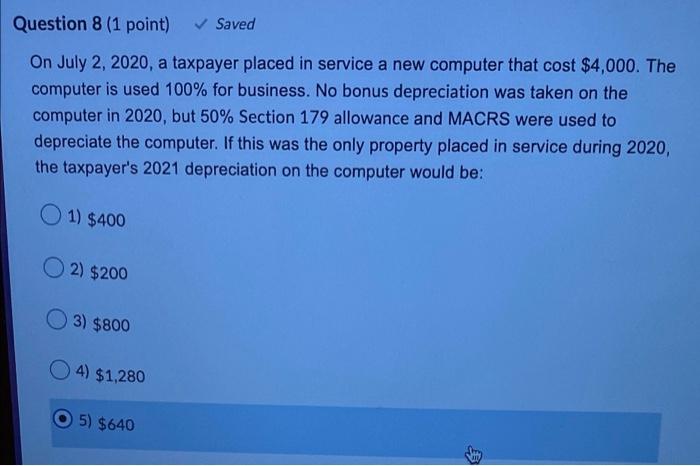

Question 8 (1 point) Saved On July 2, 2020, a taxpayer placed in service a new computer that cost $4,000. The computer is used 100% for business. No bonus depreciation was taken on the computer in 2020, but 50% Section 179 allowance and MACRS were used to depreciate the computer. If this was the only property placed in service during 2020, the taxpayer's 2021 depreciation on the computer would be: 1) $400 O2) $200 3) $800 4) $1,280 5) $640

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts