Question: Question 8 (1 point) You own a bond with a face value of $1000 that pays coupons semi-annually. It offers a yield of 10% (compounded

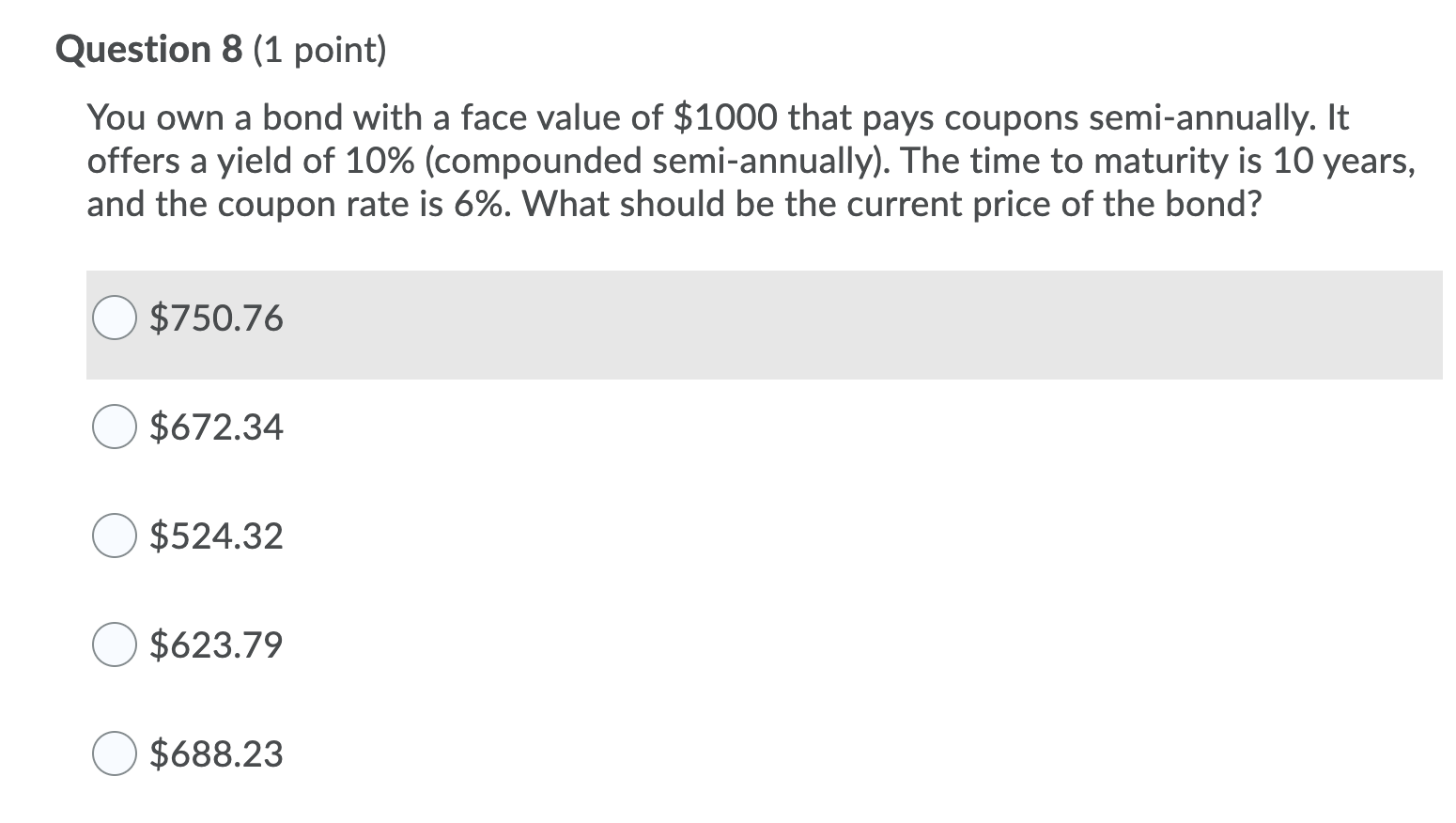

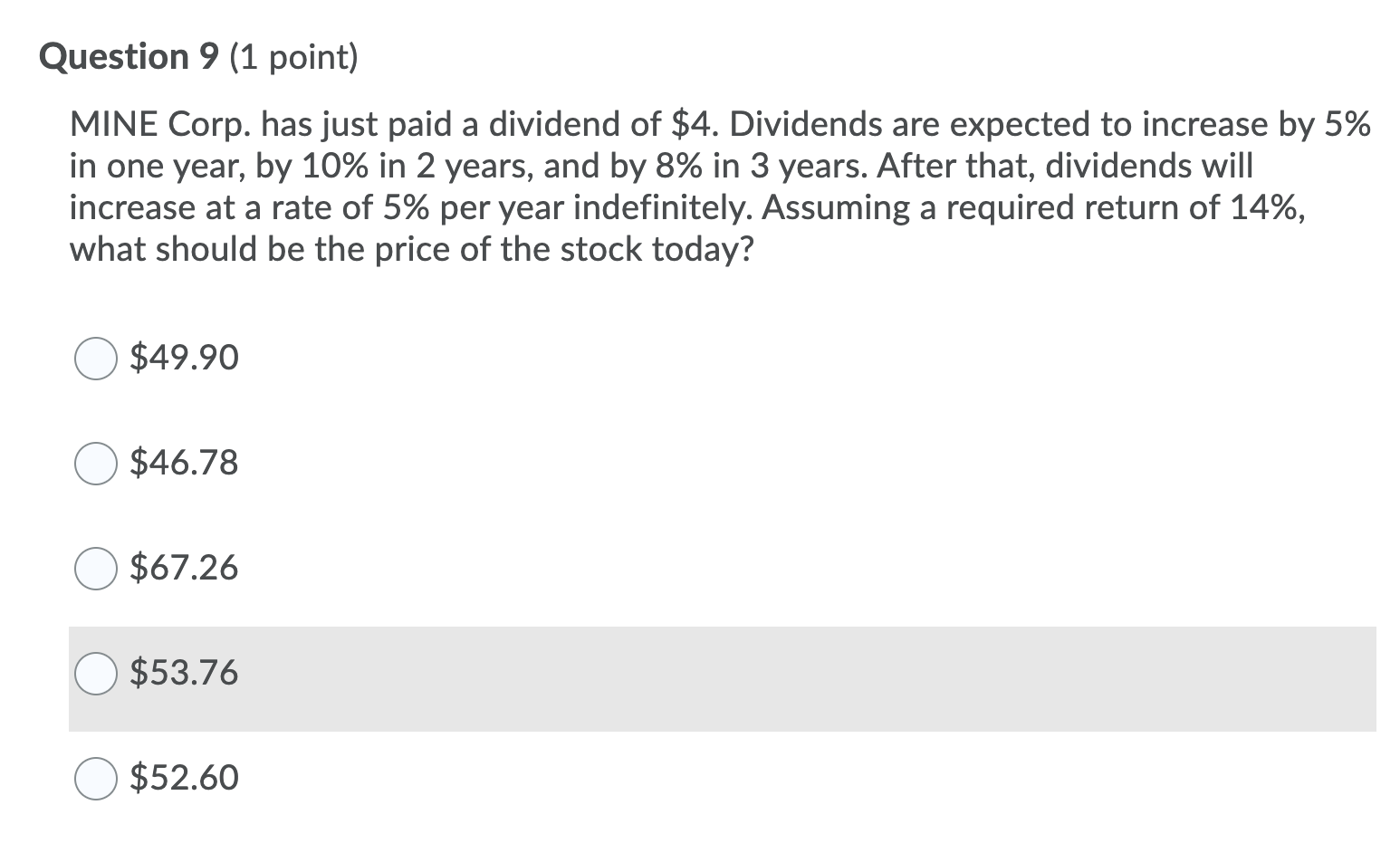

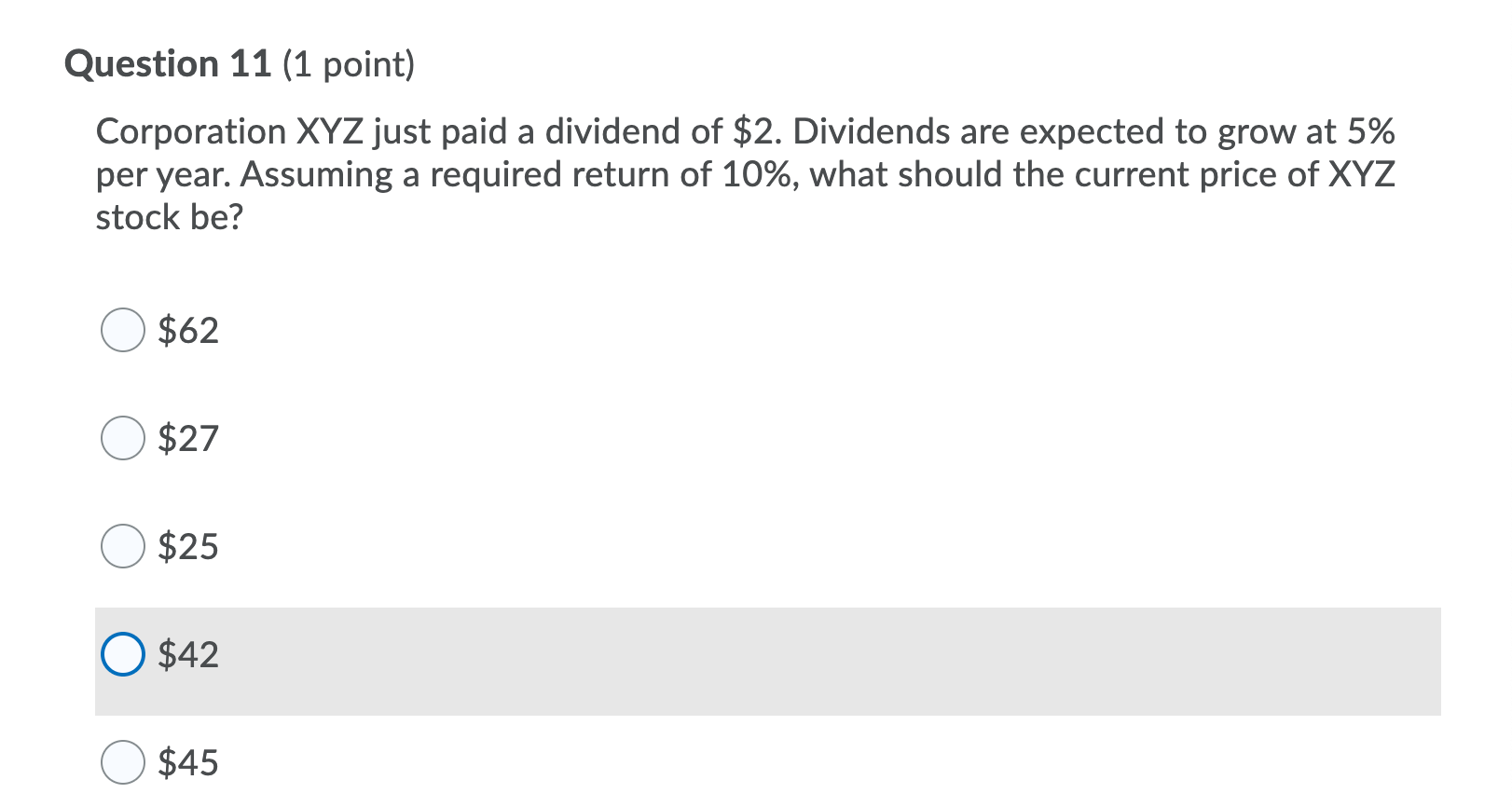

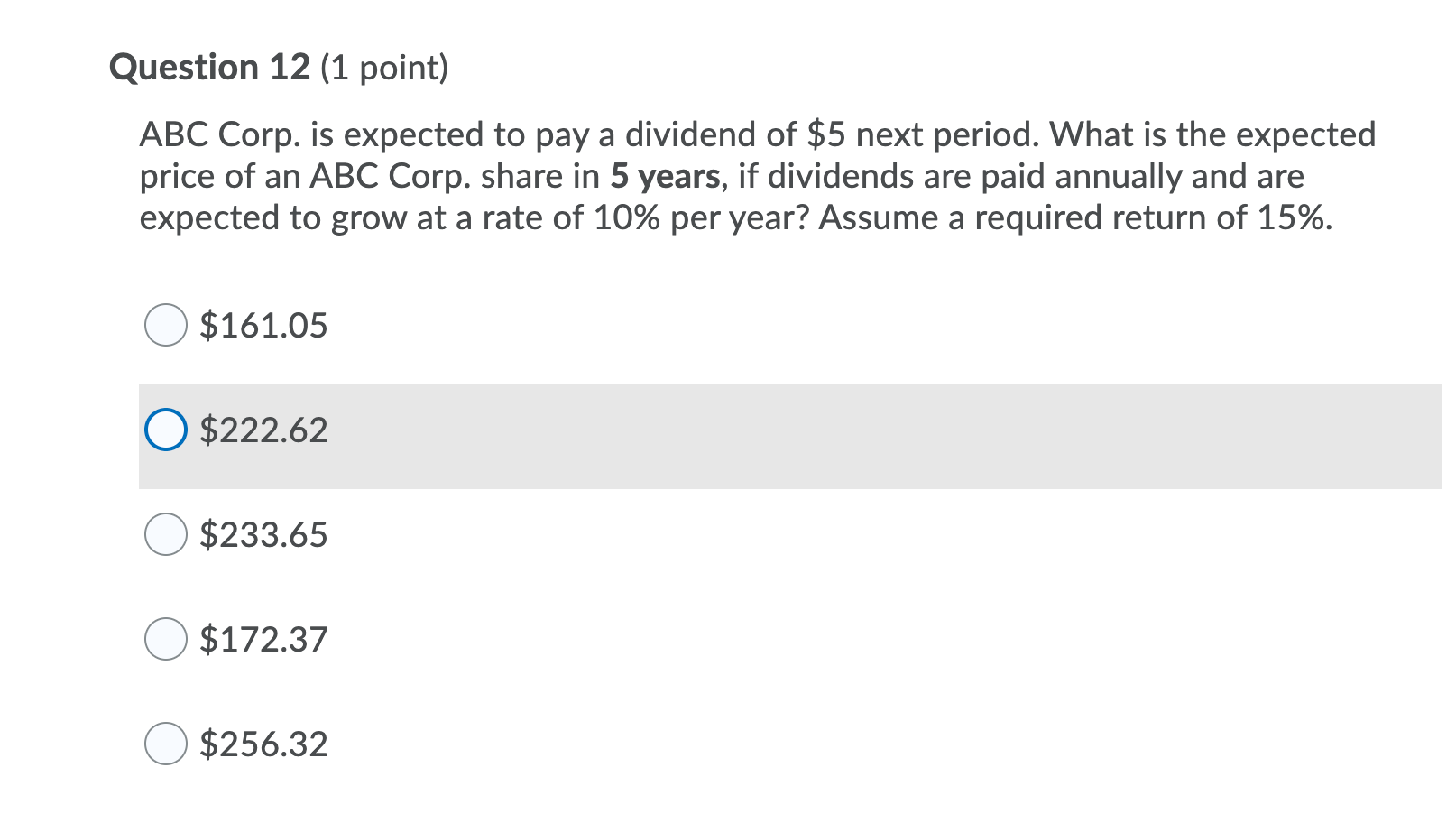

Question 8 (1 point) You own a bond with a face value of $1000 that pays coupons semi-annually. It offers a yield of 10% (compounded semi-annually). The time to maturity is 10 years, and the coupon rate is 6%. What should be the current price of the bond? $750.76 $672.34 $524.32 $623.79 $688.23 Question 9 (1 point) MINE Corp. has just paid a dividend of $4. Dividends are expected to increase by 5% in one year, by 10% in 2 years, and by 8% in 3 years. After that, dividends will increase at a rate of 5% per year indefinitely. Assuming a required return of 14%, what should be the price of the stock today? $49.90 o$46.78 $67.26 O $53.76 $52.60 Question 11 (1 point) Corporation XYZ just paid a dividend of $2. Dividends are expected to grow at 5% per year. Assuming a required return of 10%, what should the current price of XYZ stock be? $62 $27 $25 O $42 $45 Question 12 (1 point) ABC Corp. is expected to pay a dividend of $5 next period. What is the expected price of an ABC Corp. share in 5 years, if dividends are paid annually and are expected to grow at a rate of 10% per year? Assume a required return of 15%. $161.05 O $222.62 $233.65 $172.37 $256.32

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts