Question: Question 8 (Yield to Maturity) A coupon bond has a face value of $1,000 and matures in 6 years. The bond pays 6% coupons annually

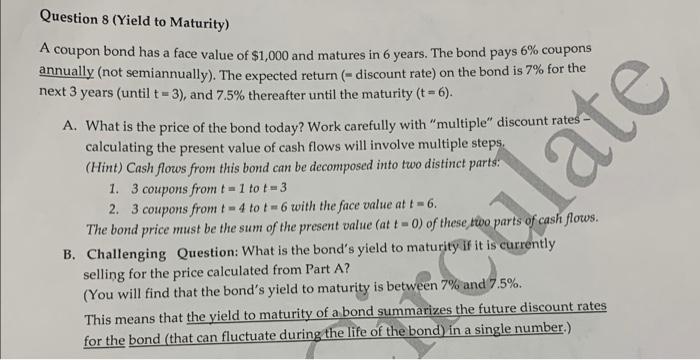

Question 8 (Yield to Maturity) A coupon bond has a face value of $1,000 and matures in 6 years. The bond pays 6% coupons annually (not semiannually). The expected return (- discount rate) on the bond is 7% for the next 3 years (until t-3), and 7.5% thereafter until the maturity (t=6). A. What is the price of the bond today? Work carefully with "multiple" discount rates calculating the present value of cash flows will involve multiple steps. (Hint) Cash flows from this bond can be decomposed into two distinct parts: 1. 3 coupons from t = 1 tot -3 2. 3 coupons from 1-4 tot 6 with the face value at t - 6. The bond price must be the sum of the present value (att-0) of these two parts of cash flows. B. Challenging Question: What is the bond's yield to maturity if it is currently selling for the price calculated from Part A? (You will find that the bond's yield to maturity is between 7% and 7.5%. This means that the yield to maturity of a bond summarizes the future discount rates for the bond (that can fluctuate during the life of the bond) in a single number.) calate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts