Question: Question 8 1 pts Using the information provided in the Amanda's Auto Repair Service question, calculate Amanda's Net Income after taxes. Assume a tax rate

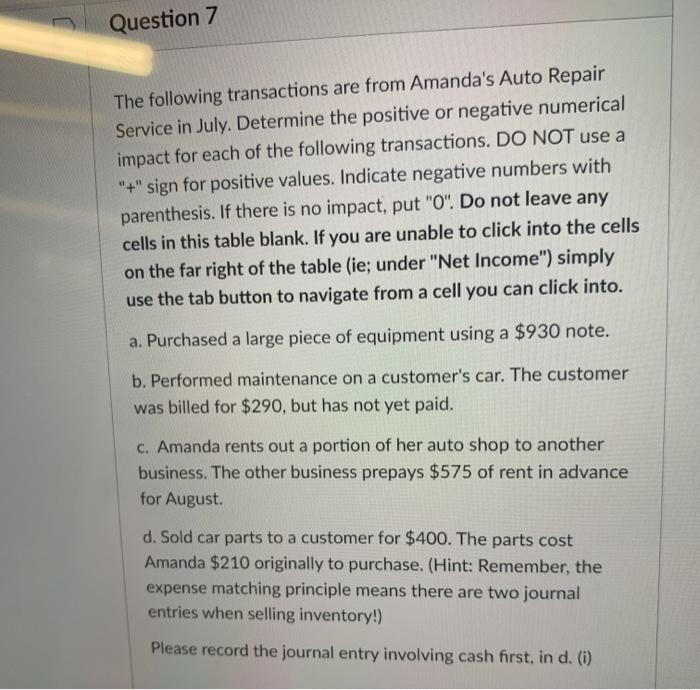

Question 8 1 pts Using the information provided in the Amanda's Auto Repair Service question, calculate Amanda's Net Income after taxes. Assume a tax rate of 24% Question 7 The following transactions are from Amanda's Auto Repair Service in July. Determine the positive or negative numerical impact for each of the following transactions. DO NOT use a "+" sign for positive values. Indicate negative numbers with parenthesis. If there is no impact, put "O". Do not leave any cells in this table blank. If you are unable to click into the cells on the far right of the table (ie; under "Net Income") simply use the tab button to navigate from a cell you can click into. a. Purchased a large piece of equipment using a $930 note. b. Performed maintenance on a customer's car. The customer was billed for $290, but has not yet paid. c. Amanda rents out a portion of her auto shop to another business. The other business prepays $575 of rent in advance for August d. Sold car parts to a customer for $400. The parts cost Amanda $210 originally to purchase. (Hint: Remember, the expense matching principle means there are two journal entries when selling inventory!) Please record the journal entry involving cash first, in d. (i)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts