Question: QUESTION 8 10 points Save Answer Today you made a $10,000 contribution to your retirement account, which now has a balance of $200,000. You plan

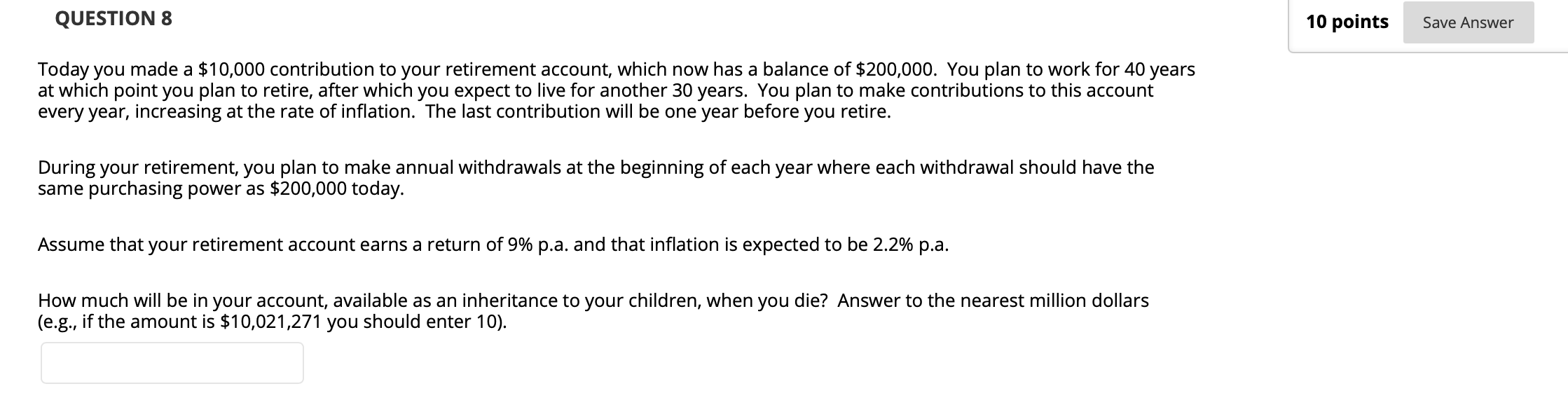

QUESTION 8 10 points Save Answer Today you made a $10,000 contribution to your retirement account, which now has a balance of $200,000. You plan to work for 40 years at which point you plan to retire, after which you expect to live for another 30 years. You plan to make contributions to this account every year, increasing at the rate of inflation. The last contribution will be one year before you retire. During your retirement, you plan to make annual withdrawals at the beginning of each year where each withdrawal should have the same purchasing power as $200,000 today. Assume that your retirement account earns a return of 9% p.a. and that inflation is expected to be 2.2% p.a. How much will be in your account, available as an inheritance to your children, when you die? Answer to the nearest million dollars (e.g., if the amount is $10,021,271 you should enter 10)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts