Question: QUESTION 8 1.5 points Save Answer Oil Well Supply offers 7.5 percent coupon bonds with annual payments and a yield to maturity of 7.68 percent.

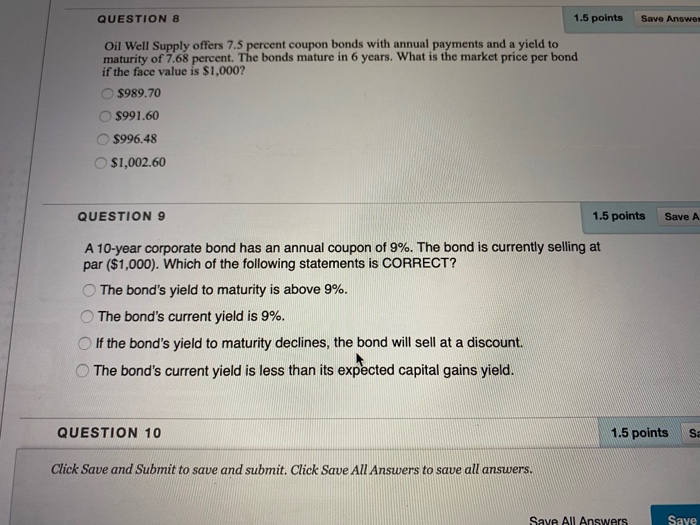

QUESTION 8 1.5 points Save Answer Oil Well Supply offers 7.5 percent coupon bonds with annual payments and a yield to maturity of 7.68 percent. The bonds mature in 6 years. What is the market price per bond if the face value is $1,000? $989.70 $991.60 $996.48 $1,002.60 QUESTION 9 1.5 points Save A A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is CORRECT? The bond's yield to maturity is above 9%. The bond's current yield is 9%. If the bond's yield to maturity declines, the bond will sell at a discount. The bond's current yield is less than its expected capital gains yield. QUESTION 10 1.5 points Sa Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts