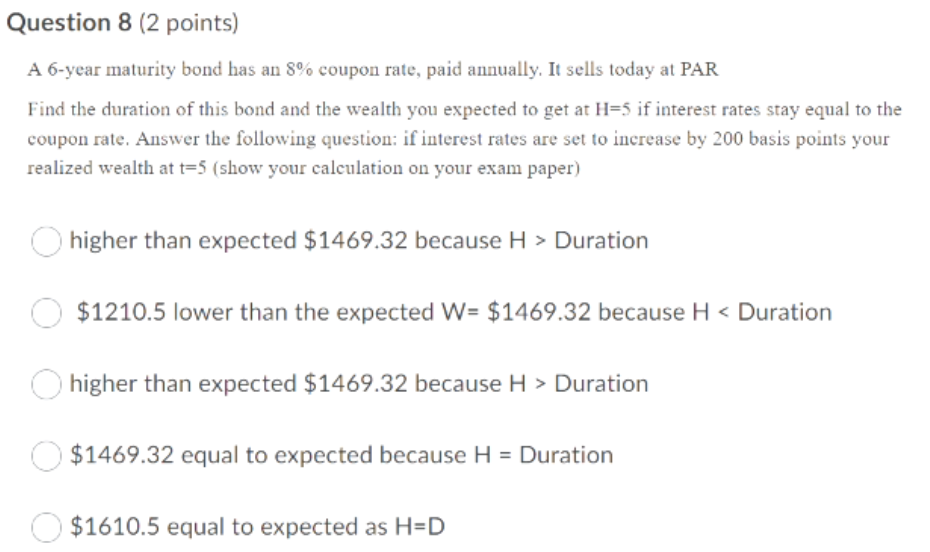

Question: Question 8 (2 points) A 6-year maturity bond has an 8% coupon rate, paid annually. It sells today at PAR Find the duration of this

Question 8 (2 points) A 6-year maturity bond has an 8% coupon rate, paid annually. It sells today at PAR Find the duration of this bond and the wealth you expected to get at H=5 if interest rates stay equal to the coupon rate. Answer the following question: if interest rates are set to increase by 200 basis points your realized wealth at t=5 (show your calculation on your exam paper) higher than expected $1469.32 because H > Duration $1210.5 lower than the expected W= $1469.32 because H Duration $1469.32 equal to expected because H = Duration $1610.5 equal to expected as H=D Question 8 (2 points) A 6-year maturity bond has an 8% coupon rate, paid annually. It sells today at PAR Find the duration of this bond and the wealth you expected to get at H=5 if interest rates stay equal to the coupon rate. Answer the following question: if interest rates are set to increase by 200 basis points your realized wealth at t=5 (show your calculation on your exam paper) higher than expected $1469.32 because H > Duration $1210.5 lower than the expected W= $1469.32 because H Duration $1469.32 equal to expected because H = Duration $1610.5 equal to expected as H=D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts