Question: Question 8 (2 points) Lucky Smart historically has had a P/E ratio of 21. This ratio is considered a good estimate of the future

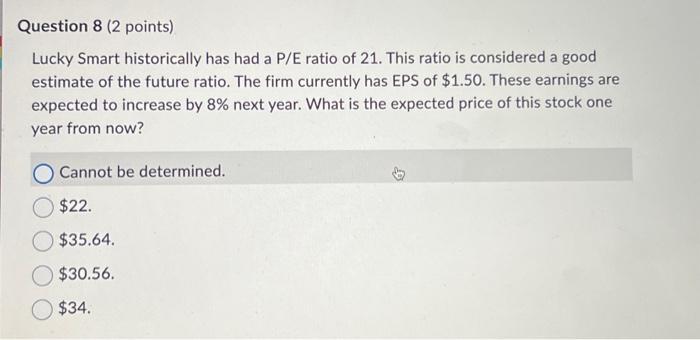

Question 8 (2 points) Lucky Smart historically has had a P/E ratio of 21. This ratio is considered a good estimate of the future ratio. The firm currently has EPS of $1.50. These earnings are expected to increase by 8% next year. What is the expected price of this stock one year from now? Cannot be determined. $22. $35.64. $30.56. $34.

Step by Step Solution

There are 3 Steps involved in it

The detailed answer for the above question is provided below The expected price of the stock one ye... View full answer

Get step-by-step solutions from verified subject matter experts