Question: Please reply without details, just tell me the correct answer QUESTION 1 Lauryn's asset beta is 1.22. Assuming a risk-free rate of 2 percent and

Please reply without details, just tell me the correct answer

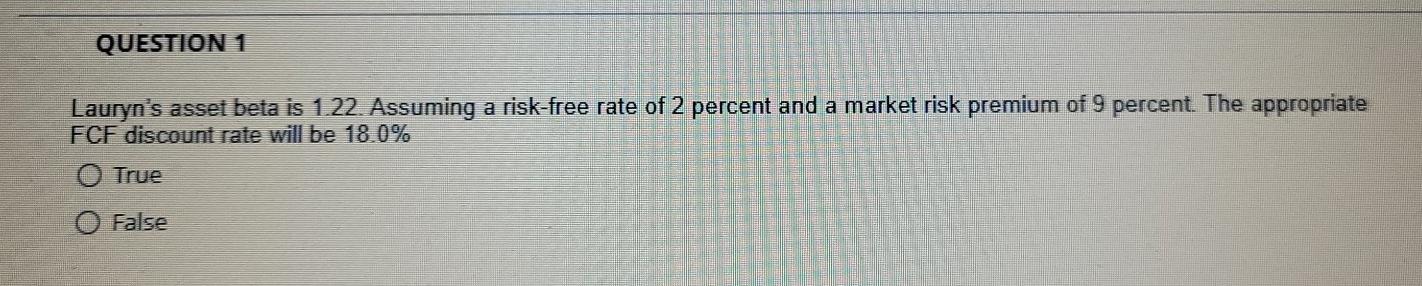

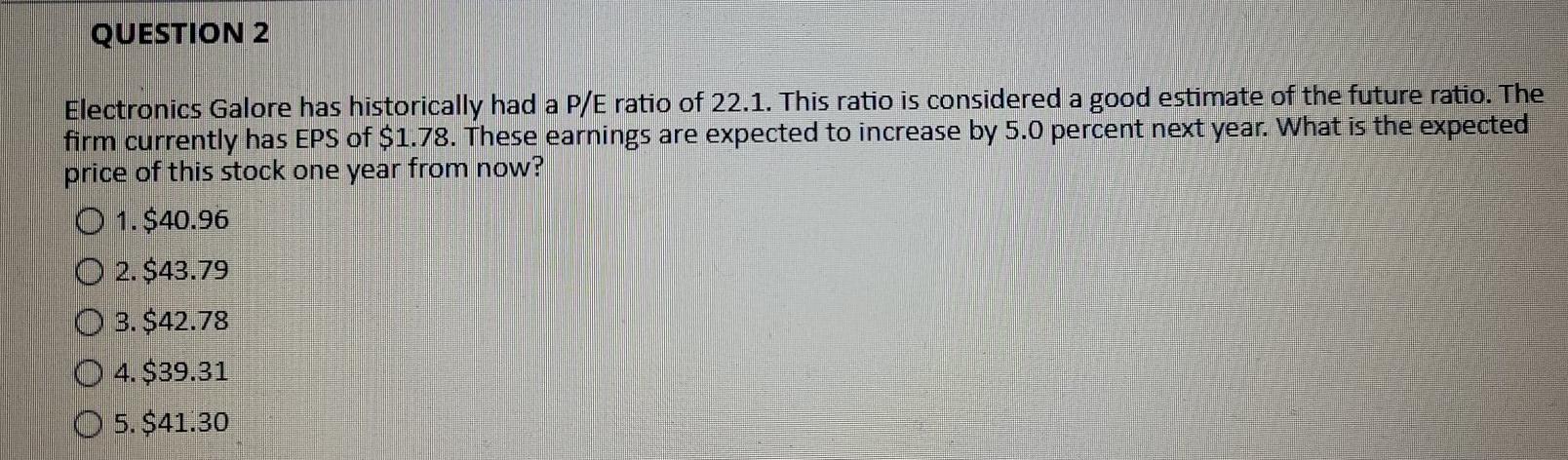

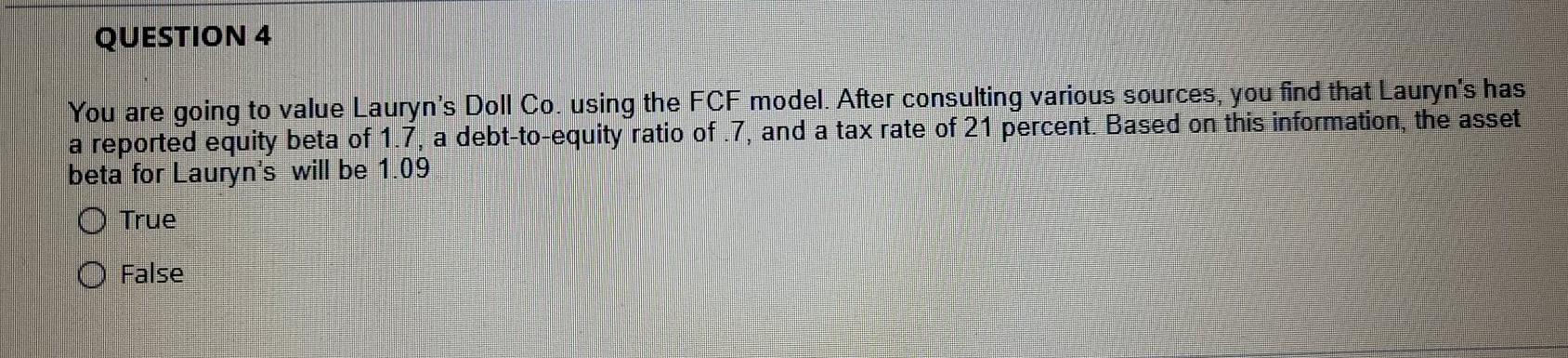

QUESTION 1 Lauryn's asset beta is 1.22. Assuming a risk-free rate of 2 percent and a market risk premium of 9 percent. The appropriate FCF discount rate will be 18.0% True O False QUESTION 2 Electronics Galore has historically had a P/E ratio of 22.1. This ratio is considered a good estimate of the future ratio. The firm currently has EPS of $1.78. These earnings are expected to increase by 5.0 percent next year. What is the expected price of this stock one year from now? O 1.$40.96 0 2.$43.79 O 3. $42.78 0 4.$39.31 O 5.$41.30 QUESTION 4 You are going to value Lauryn's Doll Co. using the FCF model. After consulting various sources, you find that Lauryn's has a reported equity beta of 1.7, a debt-to-equity ratio of .7, and a tax rate of 21 percent. Based on this information, the asset beta for Lauryn's will be 1.09 O True O False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts