Question: Question 8 3 points Save Answer Consider the investment from the previous question, in which an investor has three-quarters of their portfolio in a fund

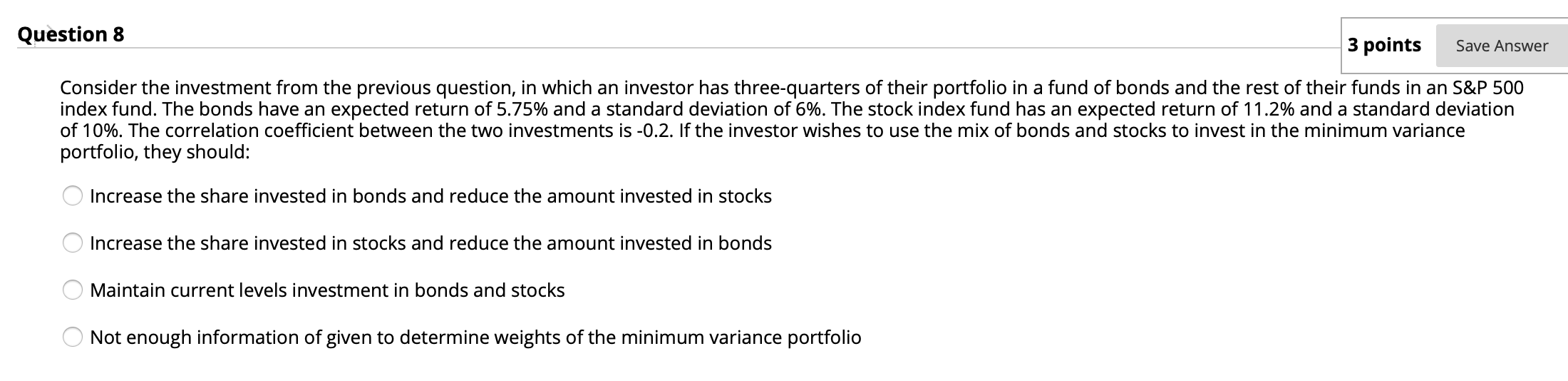

Question 8 3 points Save Answer Consider the investment from the previous question, in which an investor has three-quarters of their portfolio in a fund of bonds and the rest of their funds in an S&P 500 index fund. The bonds have an expected return of 5.75% and a standard deviation of 6%. The stock index fund has an expected return of 11.2% and a standard deviation of 10%. The correlation coefficient between the two investments is -0.2. If the investor wishes to use the mix of bonds and stocks to invest in the minimum variance portfolio, they should: Increase the share invested in bonds and reduce the amount invested in stocks Increase the share invested in stocks and reduce the amount invested in bonds Maintain current levels investment in bonds and stocks Not enough information of given to determine weights of the minimum variance portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts