Question: QUESTION 8 6 points Save Answer Lync Corp has 150 million shares outstanding trading for $18 per share. In addition, Lync has $750 million in

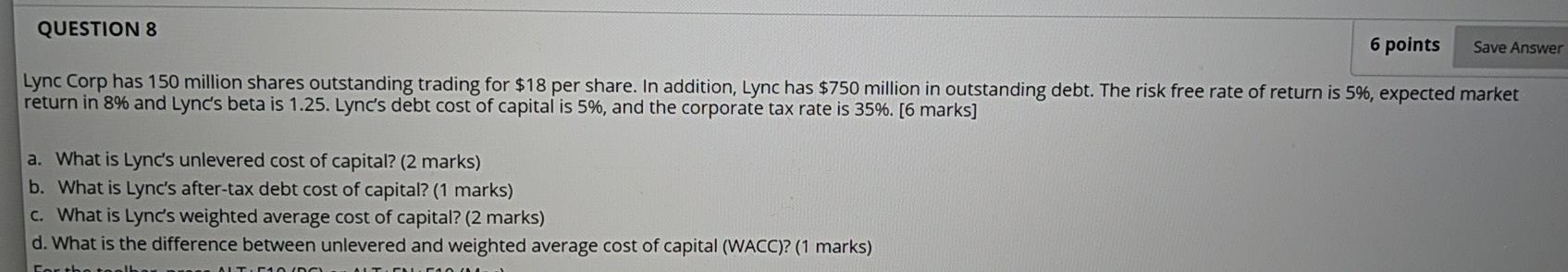

QUESTION 8 6 points Save Answer Lync Corp has 150 million shares outstanding trading for $18 per share. In addition, Lync has $750 million in outstanding debt. The risk free rate of return is 5%, expected market return in 8% and Lync's beta is 1.25. Lync's debt cost of capital is 5%, and the corporate tax rate is 35%. [6 marks] a. What is Lync's unlevered cost of capital? (2 marks) b. What is Lync's after-tax debt cost of capital? (1 marks) C. What is Lync's weighted average cost of capital? (2 marks) d. What is the difference between unlevered and weighted average cost of capital (WACC)? (1 marks) UT10 AT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts