Question: i only need C for 2 please ! and all of question 1 Question 1 25 points Save Answer General Machine has 720 million shares

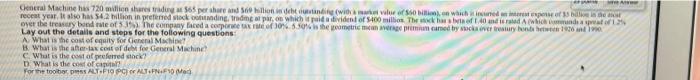

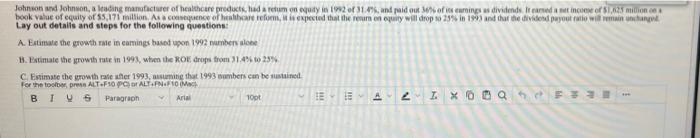

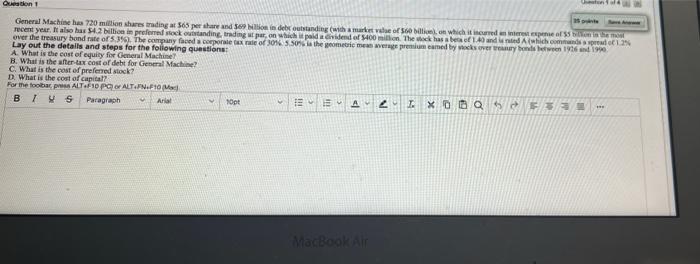

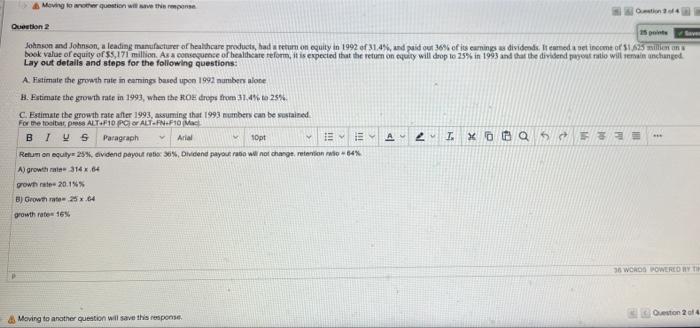

General Machine has 720 mil restridium 565 per share and shillin e linding with some which und so bile recent year. It also has 54.2 Monin prefered lock ding, trading a par, on which pad tevident of 100 million The basis of 40 and is rated A Wonde a over the truy bond of 3 15 The company faced a corporate of 10% 5.507 is the coming premium ined by die resury and 120 and Lay out the details and steps for the following questions A What is the cost of equity for General Mac 11 What is the alla costo del for General Machine C What is the cost of preferred What is the cost of capital For the toolbar DSS ALT FOPE ALTFF Med Johnson and Johnson, lading manufacturer of healthcare producted a retam nequity in 1912 of unpaid out of imings us dividends and income of 1,25 min book value of equity or 55.171 million Accequence of healthcare reform, is expected that thereum en equily will drop o 25% in 1911 and that the dividend payout ratio will remain pol Lay out details and steps for the following questions A Estimate the growth rate in coming based upon 1992 number one 1. Estimate the growth rate in 1993, when the ROE drops from 31.4% 25% Estimate the growth rate her 1993, asuming that 1993 ambers can be sustained For the tools ALT.F10 PALT.PNFO BIUS Paragon Aria 100 A 2 IX OF Question 1 General Machine has 720 million shares trading at 565 per share and 569 Million in debt outstanding (with a market value of 560 bilion which it increderea in recent year. It also has $4.2 billion in preferred rock outstanding, trading par, on which paldidend of 5400 million. The ack has been of 1.0 and which comprendo 12 over the treasury bond rate of 5.3. The company faced corporate tax rate of 30% 5.50% theometric mean werage premium came by Mocks very hand between 1976 19 Lay out the details and steps for the following questions: A What is the cost of equity for General Machine B. What is the after tax cost of debt for General Machine C. What is the cost of preferred stock? D. What is the cost of capital? For the toolbar, ALT.10 PALTIN.F10 March BIS Paragraph Arial 10pt EEA 18 F333 x MacBook Air Moving to our question will we this page Question 2 15 Johnson and Johnson, a leading manufacturer of healthcare products, had a retum on equity in 1992 of 31.4%, and paid out 30% of its earnings as dividends. It med et nemt of 1.5 million Lay out details and steps for the following questions: book value of equity of SS17 million. As a consequence of healthcare reform, it is expected that the return on equity will drop to 25% in 1993 and that the dividend payout ratio will remain unchanged A Fistimate the growth rate in camings based upon 1992 numbers alone B.Estimate the growth rate in 1999, when the ROE drops from 31.4% to 25% C. Estimate the growth rate after 1993, assuming that 1993 numbers can be sustained For me to ALTF10 Por ALT-FN-F10 Mac BIS Paragraph Arial 10pt IEEA T. X Reumon equily 25% dividend payout rete 30%, Dividend payout rate will of charge referinte -64% A) growth rate 314 64 growie 2015 B) Growth rate 25.64 growth rates 165 0 6 t 5 36 WONDO POWERED BY Moving to another question will save this response Seston 2014 General Machine has 720 mil restridium 565 per share and shillin e linding with some which und so bile recent year. It also has 54.2 Monin prefered lock ding, trading a par, on which pad tevident of 100 million The basis of 40 and is rated A Wonde a over the truy bond of 3 15 The company faced a corporate of 10% 5.507 is the coming premium ined by die resury and 120 and Lay out the details and steps for the following questions A What is the cost of equity for General Mac 11 What is the alla costo del for General Machine C What is the cost of preferred What is the cost of capital For the toolbar DSS ALT FOPE ALTFF Med Johnson and Johnson, lading manufacturer of healthcare producted a retam nequity in 1912 of unpaid out of imings us dividends and income of 1,25 min book value of equity or 55.171 million Accequence of healthcare reform, is expected that thereum en equily will drop o 25% in 1911 and that the dividend payout ratio will remain pol Lay out details and steps for the following questions A Estimate the growth rate in coming based upon 1992 number one 1. Estimate the growth rate in 1993, when the ROE drops from 31.4% 25% Estimate the growth rate her 1993, asuming that 1993 ambers can be sustained For the tools ALT.F10 PALT.PNFO BIUS Paragon Aria 100 A 2 IX OF Question 1 General Machine has 720 million shares trading at 565 per share and 569 Million in debt outstanding (with a market value of 560 bilion which it increderea in recent year. It also has $4.2 billion in preferred rock outstanding, trading par, on which paldidend of 5400 million. The ack has been of 1.0 and which comprendo 12 over the treasury bond rate of 5.3. The company faced corporate tax rate of 30% 5.50% theometric mean werage premium came by Mocks very hand between 1976 19 Lay out the details and steps for the following questions: A What is the cost of equity for General Machine B. What is the after tax cost of debt for General Machine C. What is the cost of preferred stock? D. What is the cost of capital? For the toolbar, ALT.10 PALTIN.F10 March BIS Paragraph Arial 10pt EEA 18 F333 x MacBook Air Moving to our question will we this page Question 2 15 Johnson and Johnson, a leading manufacturer of healthcare products, had a retum on equity in 1992 of 31.4%, and paid out 30% of its earnings as dividends. It med et nemt of 1.5 million Lay out details and steps for the following questions: book value of equity of SS17 million. As a consequence of healthcare reform, it is expected that the return on equity will drop to 25% in 1993 and that the dividend payout ratio will remain unchanged A Fistimate the growth rate in camings based upon 1992 numbers alone B.Estimate the growth rate in 1999, when the ROE drops from 31.4% to 25% C. Estimate the growth rate after 1993, assuming that 1993 numbers can be sustained For me to ALTF10 Por ALT-FN-F10 Mac BIS Paragraph Arial 10pt IEEA T. X Reumon equily 25% dividend payout rete 30%, Dividend payout rate will of charge referinte -64% A) growth rate 314 64 growie 2015 B) Growth rate 25.64 growth rates 165 0 6 t 5 36 WONDO POWERED BY Moving to another question will save this response Seston 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts