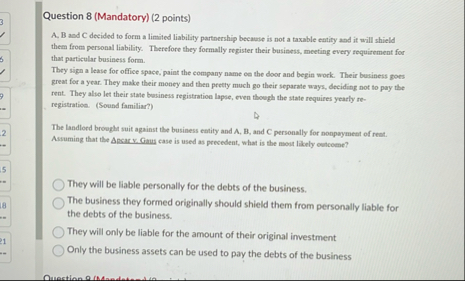

Question: Question 8 ( Mandatory ) ( 2 points ) A . B and C decided to form a limited liability partnership because is not a

Question Mandatory points

A B and decided to form a limited liability partnership because is not a taxable eatity and it will shield them from personal liability. Therefore they formally register their business, meeting every requirement for that particular business form.

They sign a lease for office space, paint the company name oe the door and begin work. Their business goes great for a year. They make their money and then peetty much go their separate ways, deciding not to pay the rent. They also let their state bosiness registration lapse, even though the state requires yearly reregistratioe. Sound familiar?

The landlord brooght suit against the business entity and and C personally for nonpayment of rent. Assuming that the Abcar.v Gaus case is used as precedent, what is the moont likely contcome?

They will be liable personally for the debts of the business.

The business they formed originally should shield them from personally liable for the debts of the business.

They will only be liable for the amount of their original investment

Only the business assets can be used to pay the debts of the business

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock