Question: Question 8 Orange Inc., a global technology company is setting up a new outlet in Cork City. The expansion project requires an initial investment of

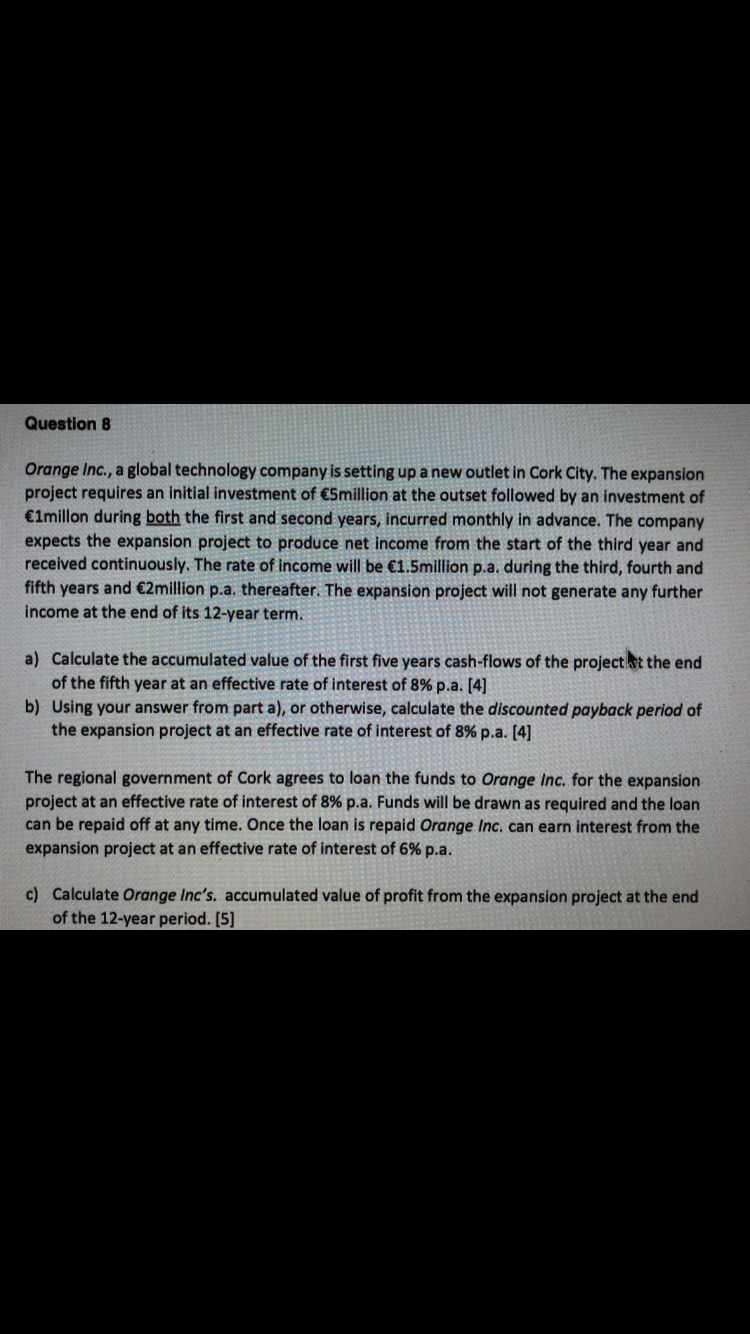

Question 8 Orange Inc., a global technology company is setting up a new outlet in Cork City. The expansion project requires an initial investment of 5million at the outset followed by an investment of 1millon during both the first and second years, incurred monthly in advance. The company expects the expansion project to produce net income from the start of the third year and received continuously. The rate of income will be 1.5million p.a. during the third, fourth and fifth years and 2million p.a. thereafter. The expansion project will not generate any further income at the end of its 12-year term. a) Calculate the accumulated value of the first five years cash-flows of the project at the end of the fifth year at an effective rate of interest of 8% p.a. [4] b) Using your answer from part a), or otherwise, calculate the discounted payback period of the expansion project at an effective rate of interest of 8% p.a. [4] The regional government of Cork agrees to loan the funds to Orange Inc. for the expansion project at an effective rate of interest of 8% p.a. Funds will be drawn as required and the loan can be repaid off at any time. Once the loan is repaid Orange Inc. can earn interest from the expansion project at an effective rate of interest of 6% p.a. c) Calculate Orange Inc's, accumulated value of profit from the expansion project at the end of the 12-year period. [5]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts