Question: Question 8, Problem 7-16 (algorithmic) = Homework: Lab 04 > HW Score: 23%, 3.45 of 15 points O Points: 0 of 1 Save Part 1

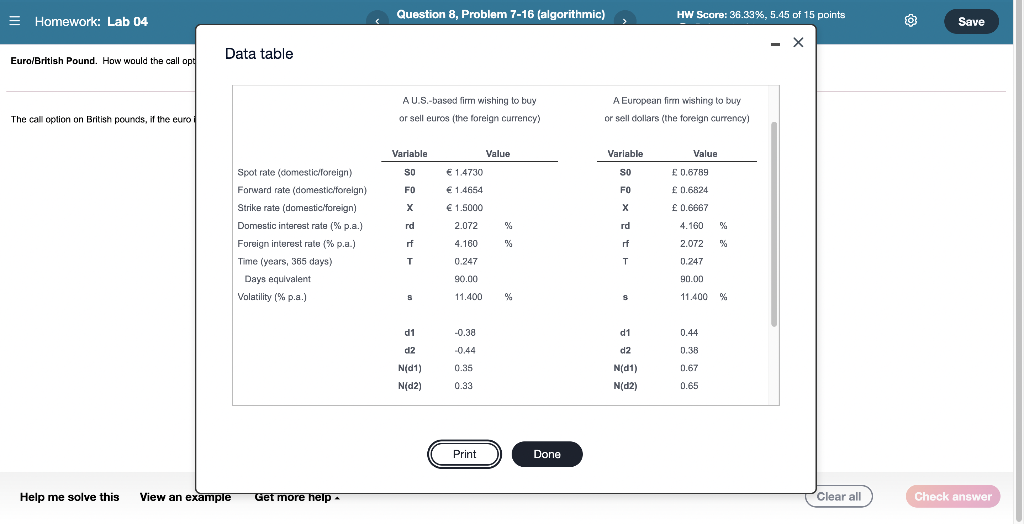

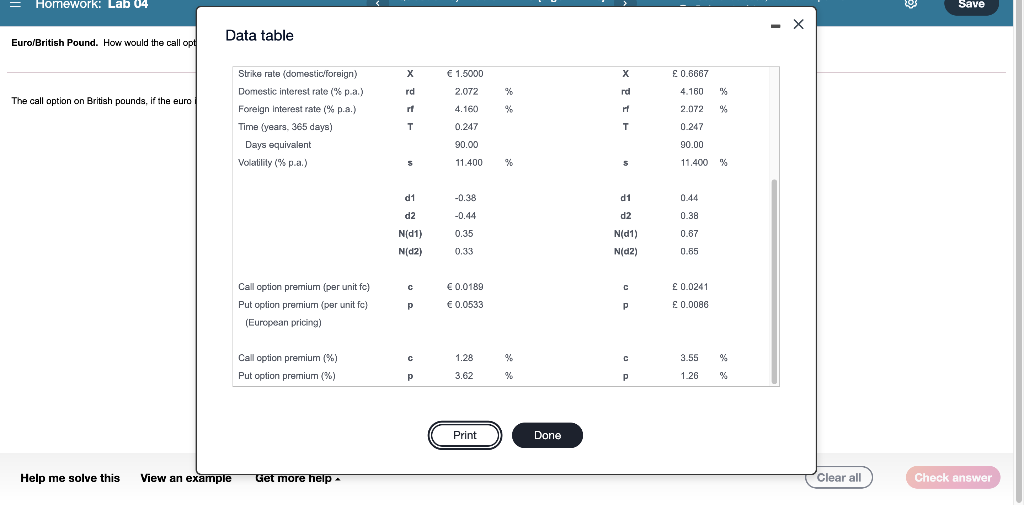

Question 8, Problem 7-16 (algorithmic) = Homework: Lab 04 > HW Score: 23%, 3.45 of 15 points O Points: 0 of 1 Save Part 1 of 2 Euro/British Pound. How would the call option premium change on the right to buy pounds with euros if the euro interest rate changed to 4.03% from the initial values listed in this table: The call option on British pounds, if the euro interest rate changed to 4.03%, would be |/. (Round to four decimal places.) Question 8, Problem 7-16 (algorithmic) HW Score: 36.33%, 5.45 of 15 points = Homework: Lab 04 0 Save - X Data table Euro/British Pound. How would the call op! ! A U.S.-based firm wishing to buy or sell euros (the foreign currency) A European firm wishing to buy or sell dollars (the foreign currency) The call option on British pounds, if the euro Value Variable Variable SO Value E 0.6789 1.4730 SO FO 1.4654 FO 0.6824 1.5000 0.6667 rd 2.072 % rd 4.160 % Spot rate (domestic foreign) Forward rate (domestic foreign) Strike rate (domestic/foreign) Domestic interest rate (% p.a.) Foreign interest rate (% p.a.) Time (years, 365 days) Days equivalent Volatility (% p.a.) rf 4.160 % rf 2.072 % T 0.247 T 0.247 90.00 90.00 B 11.400 % s 11.400 % d1 -0.38 d1 0.44 d2 -0.44 d2 0.38 0.35 N(81) 0.67 Nd1) N/d2) 0.33 N(02) 0.65 Print Done Help me solve this View an example Get more help Clear all Check answer Homework: Lab 04 Save Data table Euro/British Pound. How would the call opt x 0.6667 1.5000 2.072 rd rd 4.160 % The call option on British pounds, if the euro rf 4.160 % rt 2.072 % Strike rate (domestic foreign) Domestic interest rate (% p.a.) Foreign Interest rate (% p.a.) ) Time (years, 365 days) , Days equivalent Volatility (%p.a.) % T T 0.247 0.247 90.00 90.00 11.400 % 5 11.400 % 5 d1 -0.38 d1 0.44 d2 -0.44 d2 0.38 N(1) 0.35 Nid1) 0.67 N(02) 0.33 Nid) 0.65 0.0189 0.0241 Call option premium (per unit fc) Put option premium (per unit fc) () (European pricing) 0.0533 p 0.0086 C 1.28 % c 3.55 Call option premium (%) Put option premium (%) 3.62 P 1.26 % ( Print Done Help me solve this View an example Get more help Clear all Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts