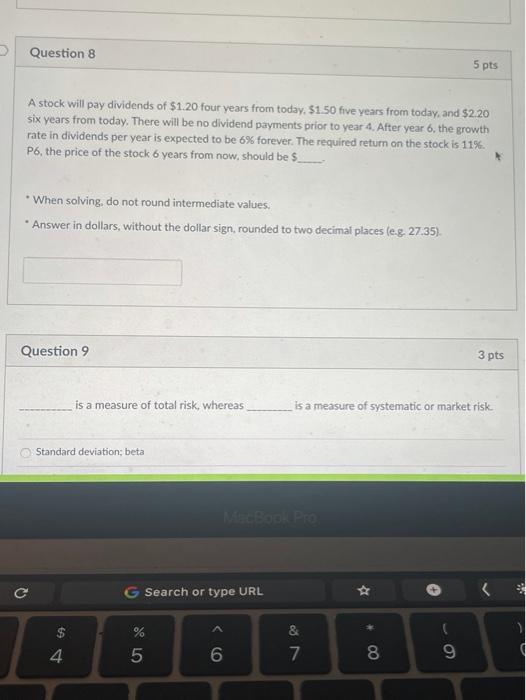

Question: Question 8 Question 8 5 pts A stock will pay dividends of $1.20 four years from today. 51.50 five years from today, and $2.20 six

Question 8 5 pts A stock will pay dividends of $1.20 four years from today. 51.50 five years from today, and $2.20 six years from today. There will be no dividend payments prior to year 4. After year 6, the growth rate in dividends per year is expected to be 6% forever. The required return on the stock is 11%. P6, the price of the stock 6 years from now, should be $__ . When solving, do not round intermediate values. Answer in dollars, without the dollar sign, rounded to two decimal places (e.g. 27.35). Question 9 3 pts is a measure of total risk, whereas is a measure of systematic or market risk Standard deviation, beta MEBODA Pro Q G Search or type URL R % 5 & 7 C 9 4 6 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts