Question: question 8 !! Question 8 You fail to pay your annual property taxes on the November 30 deadline. The tax was $1,482.65. You are charged

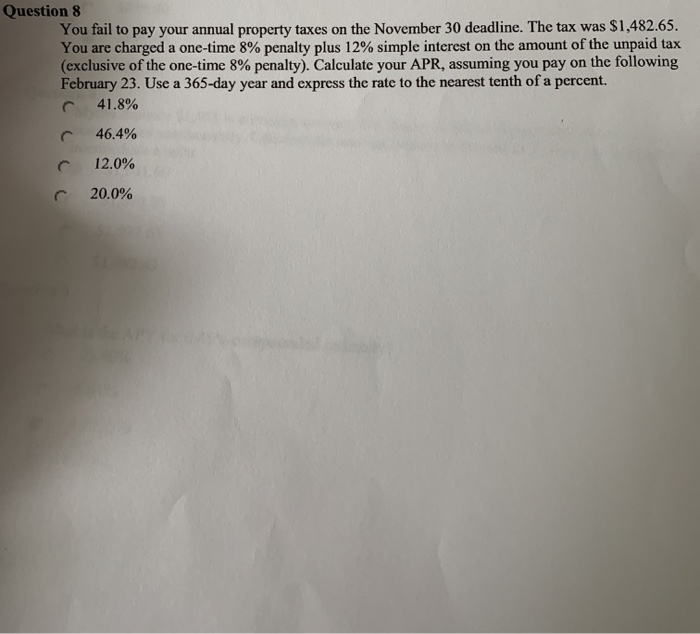

Question 8 You fail to pay your annual property taxes on the November 30 deadline. The tax was $1,482.65. You are charged a one-time 8% penalty plus 12% simple interest on the amount of the unpaid tax (exclusive of the one-time 8% penalty). Calculate your APR, assuming you pay on the following February 23. Use a 365-day year and express the rate to the nearest tenth of a percent. 41.8% 46.4% 12.0% 20.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts