Question: Question 8 Study the scenario and complete the questions that follows: Healthy Living Studios Healthy Living Studios manufactures and sells fitness accessories to sports men

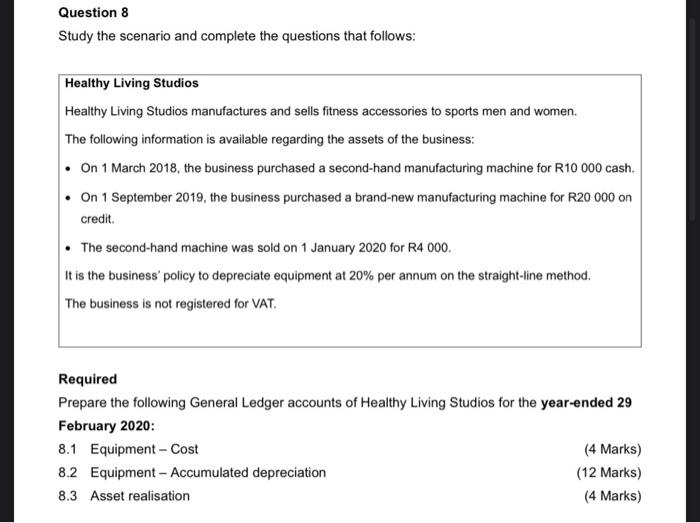

Question 8 Study the scenario and complete the questions that follows: Healthy Living Studios Healthy Living Studios manufactures and sells fitness accessories to sports men and women. The following information is available regarding the assets of the business: On 1 March 2018, the business purchased a second-hand manufacturing machine for R10 000 cash. On 1 September 2019, the business purchased a brand-new manufacturing machine for R20 000 on credit The second-hand machine was sold on 1 January 2020 for R4 000 it is the business' policy to depreciate equipment at 20% per annum on the straight-line method. The business is not registered for VAT. Required Prepare the following General Ledger accounts of Healthy Living Studios for the year-ended 29 February 2020: 8.1 Equipment - Cost (4 Marks) 8.2 Equipment - Accumulated depreciation (12 Marks) 8.3 Asset realisation (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts