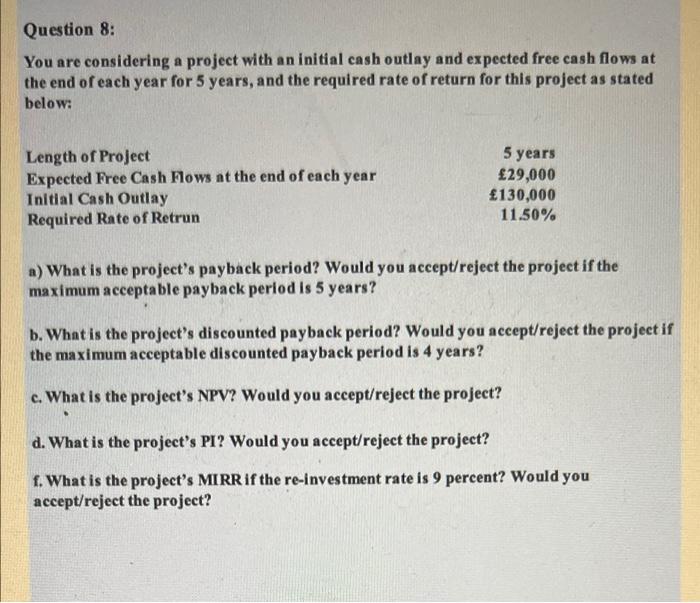

Question: Question 8: You are considering a project with an initial cash outlay and expected free cash flows at the end of each year for 5

Question 8: You are considering a project with an initial cash outlay and expected free cash flows at the end of each year for 5 years, and the required rate of return for this project as stated below: Length of Project 5 years 29,000 Expected Free Cash Flows at the end of each year Initial Cash Outlay 130,000 Required Rate of Retrun 11.50% a) What is the project's payback period? Would you accept/reject the project if the maximum acceptable payback period is 5 years? b. What is the project's discounted payback period? Would you accept/reject the project if the maximum acceptable discounted payback period is 4 years? c. What is the project's NPV? Would you accept/reject the project? d. What is the project's PI? Would you accept/reject the project? f. What is the project's MIRR if the re-investment rate is 9 percent? Would you accept/reject the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts