Question: QUESTION 8.25 (Car expenses using logbook and expense data) 2aug Rory derives business income from a retail cosmetics store. On 1 October 2019, 63 Rory

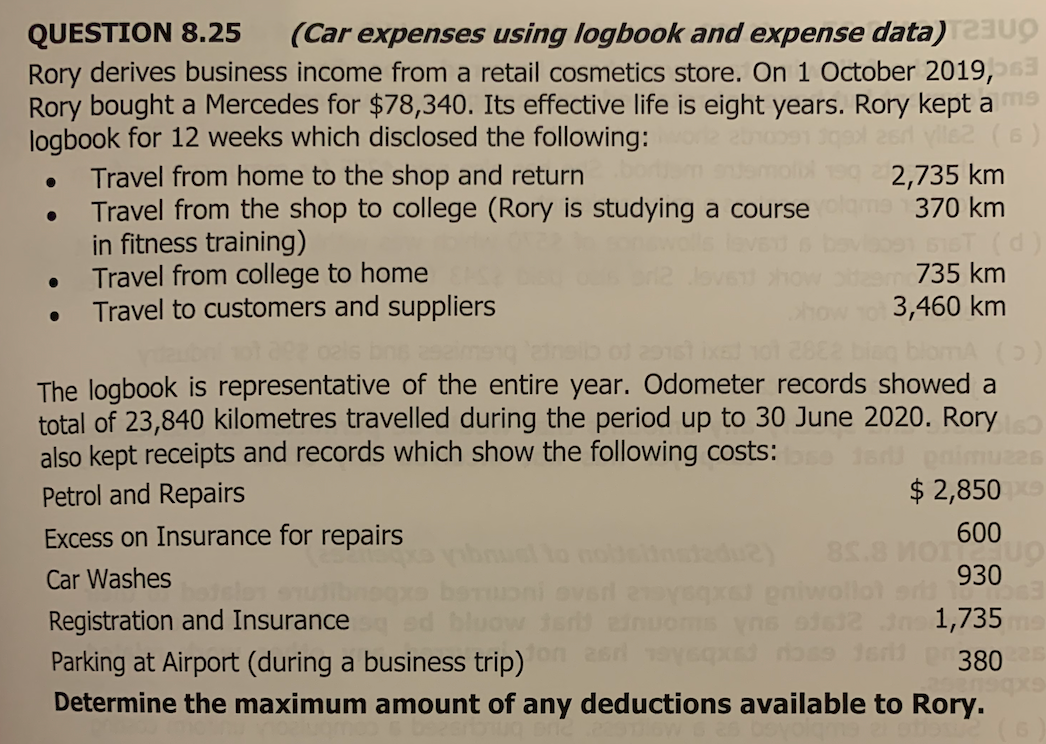

QUESTION 8.25 (Car expenses using logbook and expense data) 2aug Rory derives business income from a retail cosmetics store. On 1 October 2019, 63 Rory bought a Mercedes for $78,340. Its effective life is eight years. Rory kept a mo logbook for 12 weeks which disclosed the following: (6 ) Travel from home to the shop and return 2,735 km Travel from the shop to college (Rory is studying a course 370 km in fitness training) level s bavloos d Travel from college to home World levent how offee 735 km Travel to customers and suppliers Show 3,460 km adnello of 29 Fixed 101 2882 blomA () The logbook is representative of the entire year. Odometer records showed a total of 23,840 kilometres travelled during the period up to 30 June 2020. Rory also kept receipts and records which show the following costs: muz26 Petrol and Repairs $ 2,850 Excess on Insurance for repairs 600 (a yibrul to noblelingledue) 85.8 NO Car Washes jooxo benoni overl easyagxel pniwollol ord 930 Registration and Insurance sed blow farid einuoms you 91612 no 1,735 Parking at Airport (during a business trip) of as levequed ross farid pn 380 Determine the maximum amount of any deductions available to Rory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts