Question: Question 9 ( 1 point ) These days the benefits of tax haven subsidiaries have been reduced by the present corporate income tax rate in

Question point

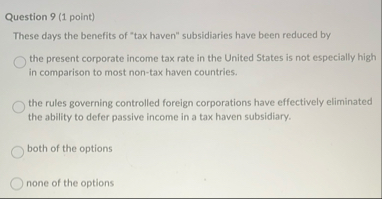

These days the benefits of "tax haven" subsidiaries have been reduced by

the present corporate income tax rate in the United States is not especially high in comparison to most nontax haven countries.

the rules governing controlled foreign corporations have effectively eliminated the ability to defer passive income in a tax haven subsidiary.

both of the options

none of the options

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock