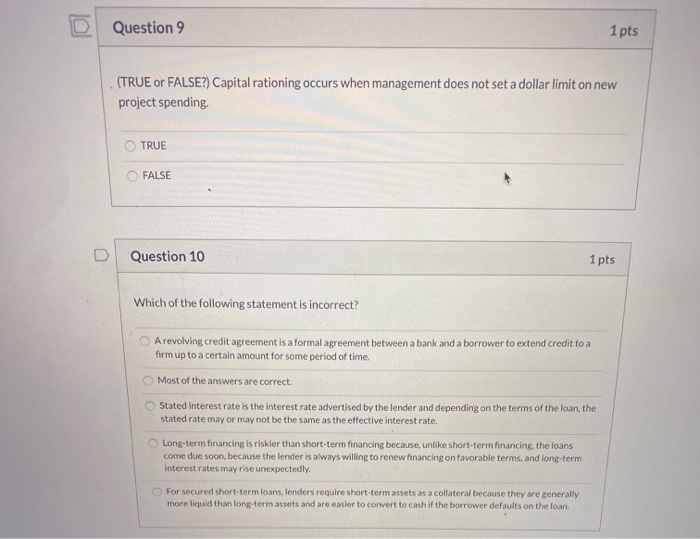

Question: Question 9 1 pts (TRUE or FALSE?) Capital rationing occurs when management does not set a dollar limit on new project spending TRUE FALSE Question

Question 9 1 pts (TRUE or FALSE?) Capital rationing occurs when management does not set a dollar limit on new project spending TRUE FALSE Question 10 1 pts Which of the following statement is incorrect? 00 A revolving credit agreement is a formal agreement between a bank and a borrower to extend credit to a form up to a certain amount for some period of time. Most of the answers are correct. Stated interest rate is the interest rate advertised by the lender and depending on the terms of the loan, the stated rate may or may not be the same as the effective interest rate. Long-term financing is riskier than short-term financing because, unlike short-term financing the loans come due soon, because the lender is always willing to renew financing on favorable terms, and long-term interest rates may rise unexpectedly. For secured short-term loans, lenders require short-term assets as a collateral because they are generally more liquid than long-term assets and are easier to convert to cash if the borrower defaults on the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts