Question: Question 9 10 pts A commercial property has expected first year NOI of $45,000. If the required debt coverage ratio is 1.25 for a mortgage

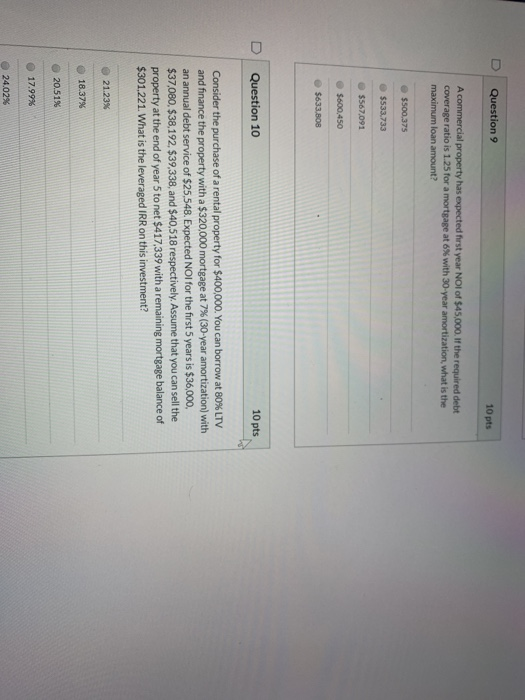

Question 9 10 pts A commercial property has expected first year NOI of $45,000. If the required debt coverage ratio is 1.25 for a mortgage at 6 % with 30-year amortization, what is the maximum loan amount? e $500,375 $533,733 $567,091 $600,450 $633,808 Question 10 10 pts Consider the purchase of a rental property for $400,000. You can borrow at 80% LTV and finance the property with a $320,000 mortgage at 7 % ( 30-year amortization) with an annual debt service of $25,548. Expected NOI for the first 5 years is $36,000, $37,080, $38,192, $39,338, and $40,518 respectively. Assume that you can sell the property at the end of year 5 to net $417,339 with a remaining mortgage balance of $301,221. What is the leveraged IRR on this investment? 21.23% 18.37% 20.51% 17.99 % 24.02 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts