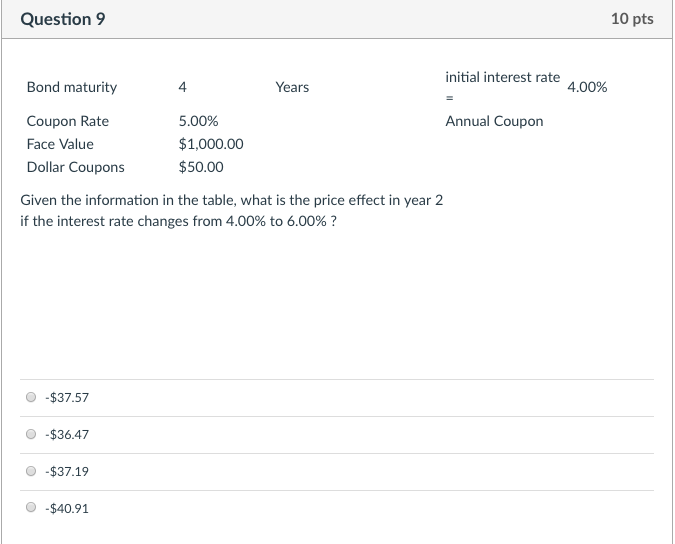

Question: Question 9 10 pts initial interest rate 4.00% Bond maturity 4 5.00% $1,000.00 $50.00 Years Coupon Rate Face Value Dollar Coupons Annual Coupon Given the

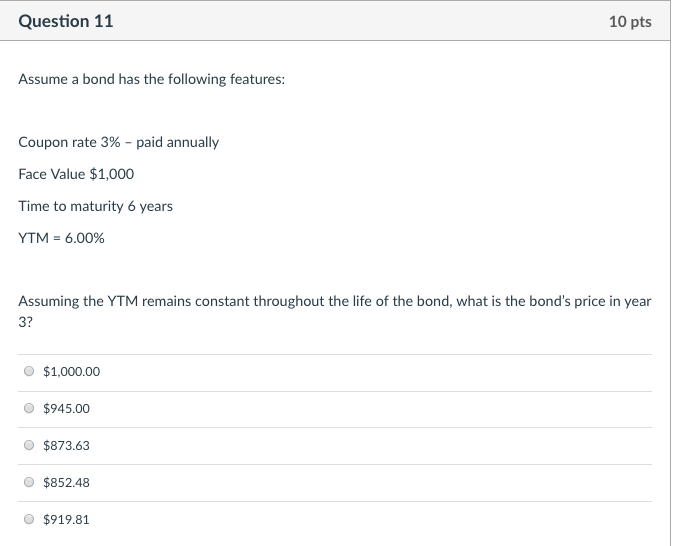

Question 9 10 pts initial interest rate 4.00% Bond maturity 4 5.00% $1,000.00 $50.00 Years Coupon Rate Face Value Dollar Coupons Annual Coupon Given the information in the table, what is the price effect in year 2 if the interest rate changes from 4.00% to 6.00% ? 0 -$37.57 0-$36.47 O-$37.19 0-$40.91 Question 11 10 pts Assume a bond has the following features: Coupon rate 3%-paid annually Face Value $1,000 Time to maturity 6 years YTM = 6.00% Assuming the YTM remains constant throughout the life of the bond, what is the bond's price in year 3? $1,000.00 O $945.00 O$873.63 O$852.48 O $919.81

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts