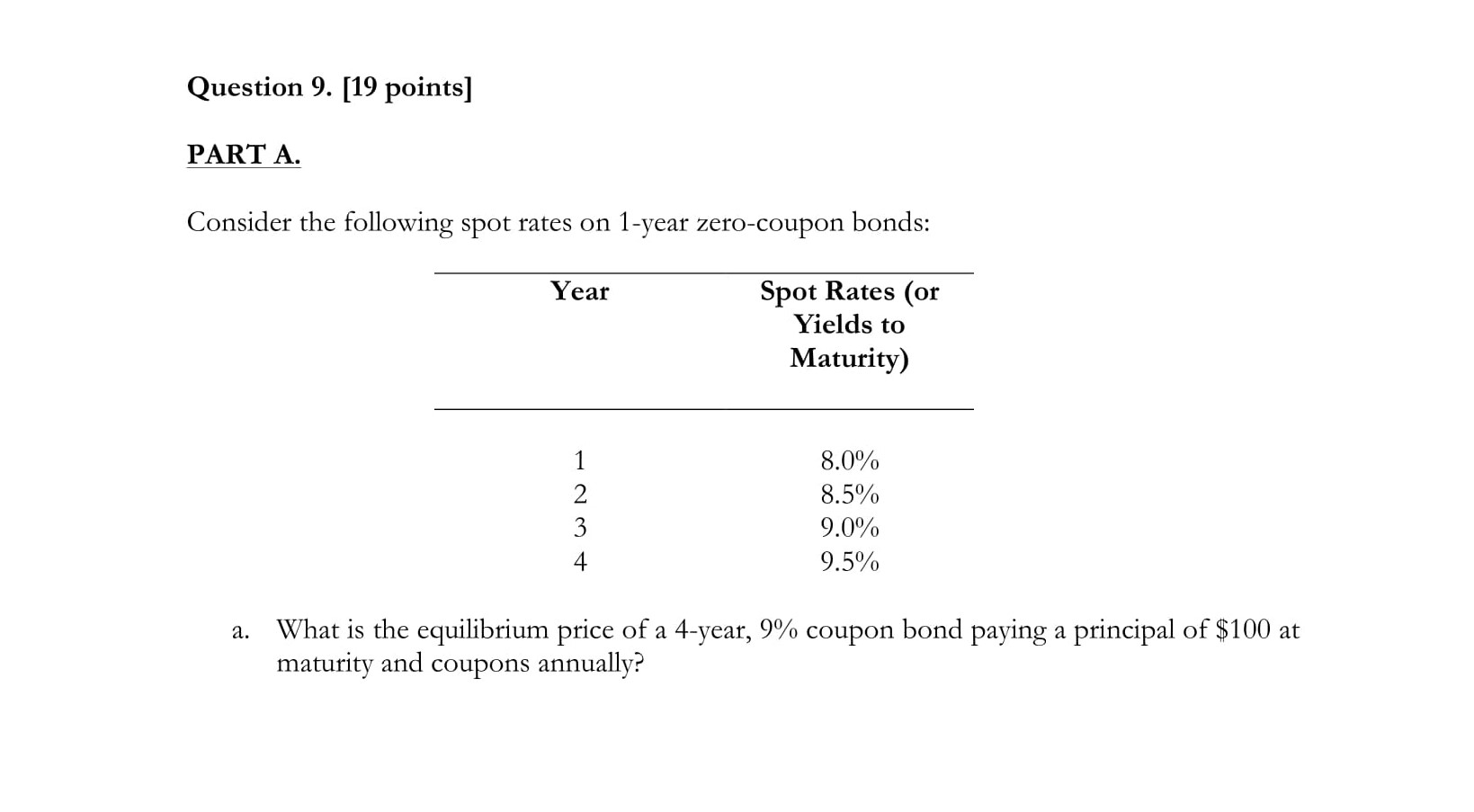

Question: Question 9. [19 points) PART A. Consider the following spot rates on 1-year zero-coupon bonds: Year Spot Rates (or Yields to Maturity) 1 2 3

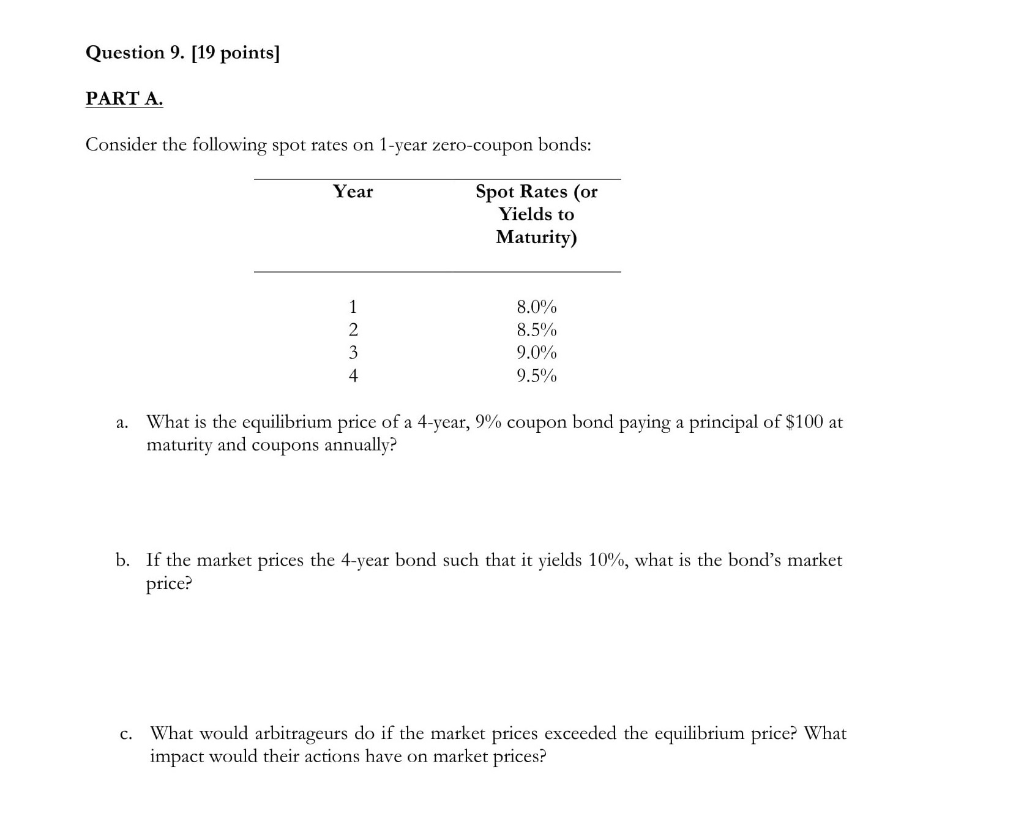

Question 9. [19 points) PART A. Consider the following spot rates on 1-year zero-coupon bonds: Year Spot Rates (or Yields to Maturity) 1 2 3 8.0% 8.5% 9.0% 9.5% 4 a. What is the equilibrium price of a 4-year, 9% coupon bond paying a principal of $100 at maturity and coupons annually? Question 9. [19 points] PART A. Consider the following spot rates on 1-year zero-coupon bonds: Year Spot Rates (or Yields to Maturity) 1 2 3 4 8.0% 8.5% 9.0% 9.5% a. What is the equilibrium price of a 4-year, 9% coupon bond paying a principal of $100 at maturity and coupons annually? b. If the market prices the 4-year bond such that it yields 10%, what is the bond's market price? c. What would arbitrageurs do if the market prices exceeded the equilibrium price? What impact would their actions have on market prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts