Question: Question 9 2 points Save Answer You are considering opening a new plant. Although long-term cash flows are difficult to estimate, management has projected the

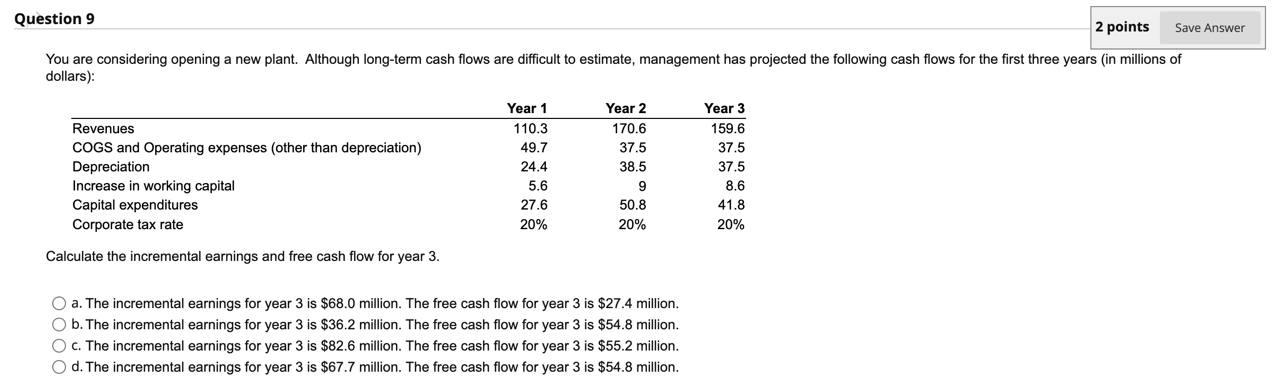

Question 9 2 points Save Answer You are considering opening a new plant. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first three years (in millions of dollars): Year 1 Year 2 Year 3 Revenues 110.3 170.6 159.6 COGS and Operating expenses (other than depreciation) 49.7 37.5 37.5 Depreciation 24.4 38.5 37.5 Increase in working capital 5.6 9 8.6 Capital expenditures 27.6 50.8 41.8 Corporate tax rate 20% 20% 20% Calculate the incremental earnings and free cash flow for year 3. O a. The incremental earnings for year 3 is $68.0 million. The free cash flow for year 3 is $27.4 million. O b. The incremental earnings for year 3 is $36.2 million. The free cash flow for year 3 is $54.8 million. O c. The incremental earnings for year 3 is $82.6 million. The free cash flow for year 3 is $55.2 million. O d. The incremental earnings for year 3 is $67.7 million. The free cash flow for year 3 is $54.8 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts