Question: Question 9 2 pts A coupon bond will make 50 annual coupon payments of $5,000 each and will pay a face value of $100,000 at

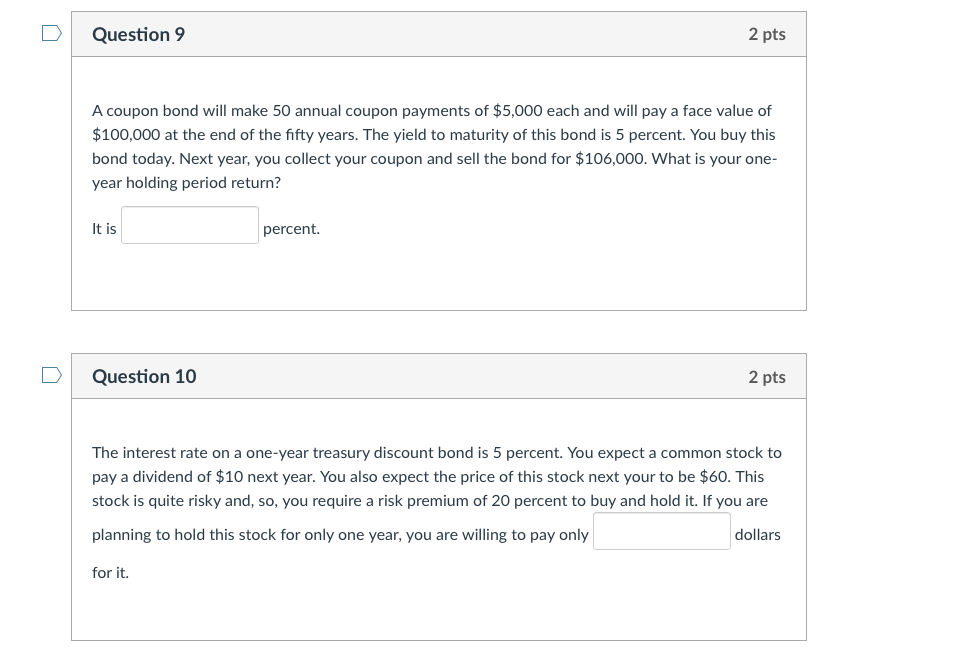

Question 9 2 pts A coupon bond will make 50 annual coupon payments of $5,000 each and will pay a face value of $100,000 at the end of the fifty years. The yield to maturity of this bond is 5 percent. You buy this bond today. Next year, you collect your coupon and sell the bond for $106,000. What is your one- year holding period return? It is percent. Question 10 2 pts The interest rate on a one-year treasury discount bond is 5 percent. You expect a common stock to pay a dividend of $10 next year. You also expect the price of this stock next your to be $60. This stock is quite risky and, so, you require a risk premium of 20 percent to buy and hold it. If you are planning to hold this stock for only one year, you are willing to pay only dollars for it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts