Question: Question 9 3 pts You are valuing a project that your firm is currently undertaking but expects to sell 10 years from now. Next

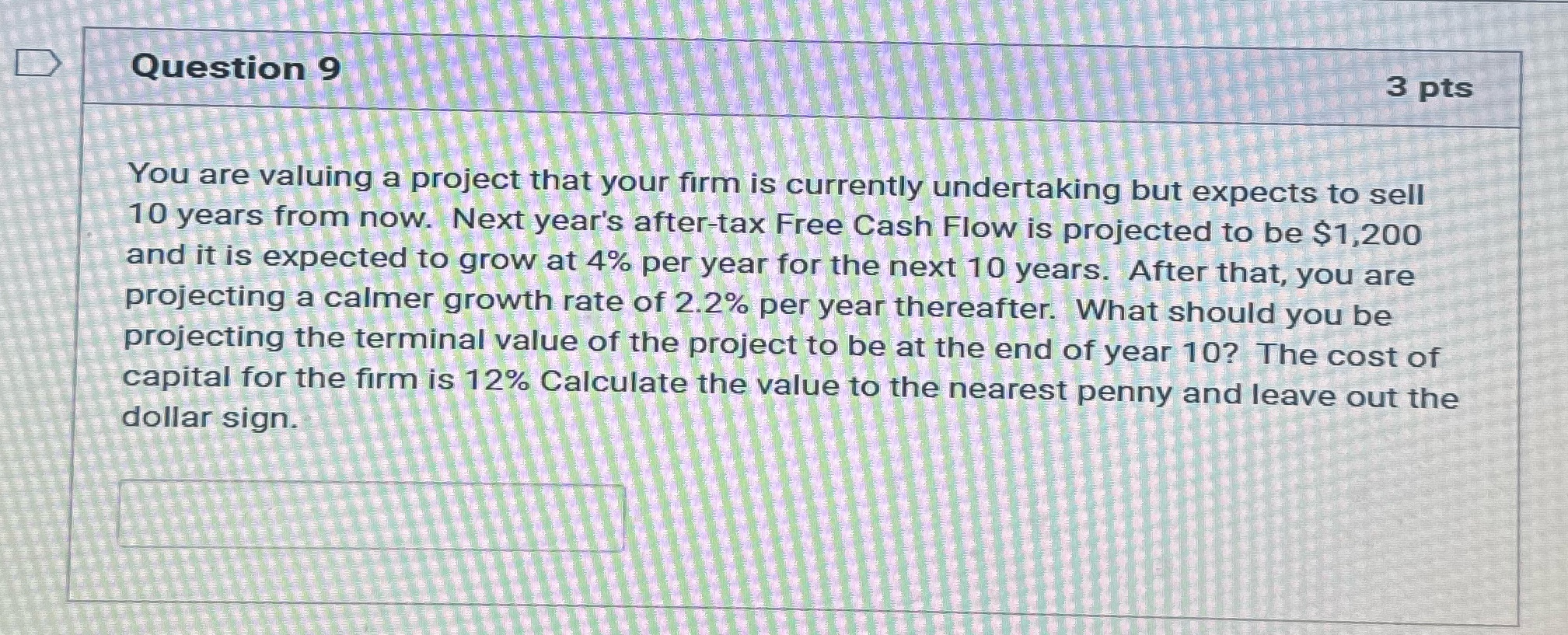

Question 9 3 pts You are valuing a project that your firm is currently undertaking but expects to sell 10 years from now. Next year's after-tax Free Cash Flow is projected to be $1,200 and it is expected to grow at 4% per year for the next 10 years. After that, you are projecting a calmer growth rate of 2.2% per year thereafter. What should you be projecting the terminal value of the project to be at the end of year 10? The cost of capital for the firm is 12% Calculate the value to the nearest penny and leave out the dollar sign.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts